The GENIUS Act Is Morphing From a Crypto Savior Into a Trojan Horse

GM. You’re reading KillChain, the tactical brief trusted by digital sleuths, fraud hunters, and crypto insiders who know the real game isn’t DeFi or CeFi; it’s deception.

We track the wallets, decode the scams, and expose the plays fraudsters pray you’ll miss. This isn’t crypto news. It’s threat intelligence. We’re the last line of defense between your protocol and the wolves, your tactical edge in a world where trust is just another exploit.

🎙️ The GENIUS Act Is Morphing From a Crypto Savior Into a Trojan Horse

They Call It Innovation. We Call It Infrastructure Warfare.

Washington just advanced a bill that could reshape global finance, and most of the world barely noticed.

The GENIUS Act, Guiding and Establishing National Innovation for U.S. Stablecoins, didn’t roar through Congress. It crept. And that’s exactly how power consolidates in modern finance: not with a bang, but with a compliance clause.

Billed as a step toward regulatory clarity, the Act promises innovation, inclusion, and consumer protection. But beneath the surface, it’s a calculated move to fortify the dollar, contain Big Tech, and give legacy banks a veto on the future of programmable money.

Let’s be clear: this is not just about stablecoins.

This is about who gets to issue money in a digital economy and under what conditions.

The Guardrails (and Grenades)

At first glance, the bill seems fair. Sensible. Certainly overdue:

1:1 Treasury-backed reserves only. No rehypothecation (reusing collateral). No algorithmic mirages.

Federal licensing for big players, state regimes for under-$10B issuers

Monthly disclosures, annual audits, and full AML/FinCEN compliance

Clear priority rights for stablecoin holders in bankruptcy

But hidden between the lines is the real playbook:

Amazon, Meta, and Walmart can’t issue stablecoins without federal approval and only if they don’t tie them to their platforms, ad ecosystems, or marketplaces.

Foreign stablecoins get three years before they're banned unless their governments sign reciprocity deals and can freeze assets on demand

Banking incumbents are exempt from capital requirements, a direct nod to the lobbyists keeping Treasury’s inbox full.

BigTech faces anti-tying, data use, and ethical constraints banks never had to navigate

In short: Banks get a glidepath. Big Tech gets a kill switch.

The Banks Are Not Just Competing… They’re Winning

The Act enshrines a two-tier system:

Banks and their subsidiaries get the Fed.

Fintechs and nonbanks get the OCC—and 120-day “shot clock” approval, after which silence equals permission.

But smaller stablecoin innovators?

They’re left under “state-level equivalency regimes” that must be blessed by the Treasury, Fed, and FDIC—turning decentralization into a paperwork gauntlet.

The result: Banks get to custody, issue, and clear stablecoins—with no risk-based capital penalties. Nonbanks? Jump through hoops. And if you’re over $10B in issuance, welcome to federal full-spectrum scrutiny.

Why Big Tech Is Getting Boxed Out

Amazon may move $638B annually. Walmart’s e-commerce haul just broke $100B. And yet, under the GENIUS Act, their ability to issue branded stablecoins like “AmazonCoin” or “WalmartDollar” will be blocked unless:

They decouple the coin from their platform dominance

They forfeit customer data analytics

They agree not to require use of their coin in checkout, rewards, or other product bundles

This is an anti-trust Trojan horse hidden in a monetary policy vehicle.

And Senator Josh Hawley’s proposed amendment? It would prohibit stablecoin issuance by any digital platform with over 25 million users. That’s not oversight. That’s an airstrike.

KillChain Strategic Analysis

1. This Isn’t Stablecoin Regulation. It’s Monetary Power Consolidation.

The Fed isn’t trying to kill stablecoins. It’s trying to control their issuance pipeline, restrict off-ramp freedom, and maintain the dollar’s dominance on terms banks can control.

2. The 1:1 Reserve Rule Adds Dollar Scarcity

Because stablecoins must be backed by U.S. Treasuries or equivalent, each dollar token reduces available liquidity elsewhere, creating hard monetary surface tension. Want to mint more? Buy more USTs. Scarcity meets compliance.

3. DeFi and Permissionless Models Get Strangled

The GENIUS Act doesn’t just outlaw algorithmic stablecoins, it neuters composability. If a DAO can’t meet AML or auditing standards, it’s out. Expect stablecoin rails to become siloed, surveilled, and silo-compatible only.

4. Foreign Stablecoins Will Face “U.S. Kill Switch Conditions”

No onshore presence? You’re banned after 3 years. Unless you:

Prove reserve backing

Integrate freezing tools

Submit to OCC supervision

This is digital trade warfare in disguise.

The KillChain Summary

The GENIUS Act is not just regulatory structure; it’s monetary weaponization.

It creates a legal moat around dollar-backed tokens, placing issuance power in the hands of banks, and locking out Big Tech, DAOs, and sovereign competitors.

While stablecoin legitimacy increases, so does centralization.

Watch the amendment battlefield this month: whoever controls the rails, controls the economy.

They’re not just regulating coins. They’re redrawing the lines of global financial sovereignty.

New Signal in the Chain: Stablecoin Supply Ratio (SSR)

Code Name: The Ammo Count

Last week, we armed you with Exchange Netflows, a real-time pulse check on capital in motion. Net outflows? People are removing assets from exchanges, likely to hold. Inflows? Get ready for a sell-off.

But motion doesn’t tell the whole story.

You also need to ask: “How much capital is waiting to move?”

That’s where stablecoins enter the battlefield.

What Are Stablecoins?

Stablecoins are crypto’s reserve currency.

They’re tokens like USDT (Tether), USDC (Circle), and DAI (MakerDAO) that are pegged to the U.S. dollar, designed to stay at or near $1.00 in value. They don’t fluctuate like Bitcoin or Ethereum. That’s the point.

Instead of exiting to a bank account, traders, institutions, and crypto-native whales park funds in stablecoins when they want to stay liquid, but not exposed.

Stablecoins don’t leave the game. They’re the money waiting just offstage.

When confidence returns, that money rotates back in, and fast.

In traditional finance, think of this like cash on the sidelines in a hedge fund. It’s not gone. It’s coiled.

What Is the Stablecoin Supply Ratio (SSR)?

The Stablecoin Supply Ratio measures how much of that “dry powder” exists relative to Bitcoin’s total market cap.

Formula: SSR = Bitcoin Market Cap ÷ Aggregate Supply of Major Stablecoins (USDT + USDC + DAI)

This gives us a tactical read on buying pressure potential. It answers the critical question:

“Is there enough firepower to move the price significantly?”

How to Interpret It

Low SSR (under ~2.5):

Stablecoins are large relative to BTC’s market cap. That means plenty of capital is waiting to deploy. The chamber is loaded.

Think: primed for upside if sentiment shifts.Moderate SSR (2.5–4.0):

Buying power is present, but balanced.

Markets may grind, not explode.High SSR (above 4.0):

Most capital is already deployed or has exited.

Momentum runs out of fuel.

KillChain Tactical Readout – June 12, 2025

BTC Market Cap & Liquidity Context

BTC Market Cap (June 11): $2.152 Trillion

Total Stablecoin Supply (USDT + USDC + DAI): ~$238 Billion

Stablecoin Supply Ratio (SSR): 9.04

This high SSR (>4.0) signals that stablecoin reserves are small relative to BTC’s market size. We are now sitting in high SSR territory.

The implication is clear: the stablecoin reserves, the dry powder that fuels explosive upward price movement, have largely been deployed. What's left circulating is already in the system, and that limits upside unless new capital enters. Markets are potentially more fragile and reliant on fresh capital, not parked capital.

What This Means Now

Last week, we told you BTC's system was "cocked but unlit." Today, that changed.

SSR at ~10.1 (June 14) indicates low ammunition. The fuel (stablecoins) that once powered rallies is mostly spent.

Combine that with:

MVRV Z‑Score still elevated (~2.4) → Still bullish, but not overheated

Neutral-to-slightly-positive Netflows → (≈ +$262 M on June 10), signaling repositioning more than panic

Synthesis: This is a dry momentum market. Price can drift up slowly, but explosive runs are unlikely without new stablecoin inflows or external catalysts. Price can drift up on inertia, but there’s not enough fresh liquidity for breakout velocity.

The USD Analogy

Imagine if no new U.S. dollars ever entered a stock exchange. The traders inside would just be swapping shares with each other, pushing prices up or down only marginally.

Without new dollars entering from the outside, there’s no mechanism to bid prices higher in a sustained way.

Crypto works the same way.

Stablecoins are crypto’s dollars.

When they stop flowing in, price can’t levitate, it can only rotate. That’s where we are now.

KillChain Summary

SSR is high (~9.0) → most of the capital firepower has already been fired

Sentiment still warm (MVRV ~2.4), capital faintly returning (slight inflows)

No new ammo, no major upside until fresh stablecoins flow in

USD Analogy: Just like a stock market without new dollars, crypto needs outside capital to grow. Internal reshuffling can’t drive exponential returns.

Watch for catalysts like ETF flows, government regulation, fiat ramps, or macro easing that could reload the system. Until then, manage risk, fade overconfidence, and don’t confuse rotation for expansion.

KillChain Signals & Readouts: Deep Dive

Battlefield Intelligence: What the Numbers Truly Reveal.

This isn't a dashboard. This is a tactical briefing, peeling back the layers on the market's core assets. We’re watching capital currents, decoding hidden layers, and positioning for the next market swing. Today, we add SSR to MVRV and Netflows for deeper, sharper insight.Use this intelligence to move through the fog of war.

Bitcoin (BTC)

MVRV Z‑Score: ~ 2.53 (as of June 12): comfortably bullish, but far from excess .

Exchange Netflows: +$262M inflow (June 10): not panic, but profit-taking .

Stablecoin Supply Ratio (SSR):

Market Cap: ~$2.15T

Stablecoin Supply (USDT + USDC + DAI): ~$218B (approximate)

SSR ≈ 10.1 (June 14) → high territory

Read:

Z-Score indicates a well-grounded rally, no mania

Netflows show strategic rotation, not capitulation

SSR suggests dry momentum—liquidity is scarce; existing capital is being shuffled, not augmented

KillChain Tactical Readout for BTC:

We’re no longer in the quiet before the ambush. We’re in rotation without reinforcement. The charts show strength, but the SSR screams scarcity. This isn’t a flashpoint moment, but rather choreography before escalation.

Maintain modular positions. The inflows we’re seeing aren’t conviction; they’re calculus. Traders are reallocating, not charging.

The real move?

It won’t come from within the market. It will come from outside it—a stablecoin surge, a regulatory greenlight, or a sovereign-sized ETF wave.

Until then:

Don’t mistake drift for dominance. Monitor velocity. Count the ammo. And wait for the reload.

This is a buy zone, not a blind zone.

Ethereum (ETH)

MVRV Z‑Score: ~ –0.14 (June 11): still under cost basis; undervalued

Exchange Netflows: Negative flow persists, suggesting accumulation and long-term intent .

SSR Impact: ETH holds less sway from SSR dynamics, but its fellow ammo-constraint means any stablecoin liquidity is more likely to flow into it.

Read:

ETH remains deeply discounted

Netflows show strategic accumulation

Stablecoin scarcity magnifies demand for cheap ETH

KillChain Tactical Readout for ETH:

ETH remains mispriced—and increasingly misperceived. The MVRV Z-Score sits at –0.14, signaling that Ethereum is still trading below its on-chain cost basis. This isn’t volatility, it’s undervaluation. Add in continued net outflows and you have a conviction signal: the smart money isn’t just holding, it’s disappearing into cold storage.

Meanwhile, BTC steals the headlines, but ETH is where asymmetric positioning is quietly building.

Ignore the silence at your own risk.

This Z-Score + Netflow combo still screams accumulation, but the strategic layer has changed. With SSR at 10.1, new stablecoin liquidity is limited. That means when fresh capital does arrive, it will hunt value and ETH will be first in its crosshairs.

Solana (SOL)

MVRV Z‑Score (June 14): ~0.12 — trading close to cost basis; watchlist range

Exchange Netflows: Slightly negative — signals mild accumulation

SSR Impact: SSR at 10.1 — capital is constrained, but favors assets with utility and upside

Read:

SOL sits near fair value

Light accumulation continues

Constrained liquidity amplifies breakout moves

Solana (SOL): The Execution Layer the Suits Don’t Want You Watching

Solana isn’t a meme coin or an Ethereum clone. It’s a next-gen blockchain built for speed—think Nasdaq-level throughput with gas fees that cost less than your attention span. While everyone watches Bitcoin and Ethereum fight over narrative, Solana quietly became the backbone for high-frequency DeFi, NFTs, and even real-world payments.

In short: Solana isn’t trying to be money. It’s trying to be infrastructure. And when the system reboots, that’s the layer you want to own.

KillChain Tactical Readout for SOL:

Solana isn’t cheap, but it’s coiled.

The MVRV Z‑Score is hovering just above zero, meaning the market is pricing SOL almost exactly at its on-chain cost basis. That’s rare air: it’s not undervalued, not overheated—just balanced. In tactical terms, it’s a setup, not a climax.

Netflows are slightly negative. Translation? Accumulators are still active, but cautious. This isn’t a feeding frenzy.

And that’s where SSR makes things interesting. At 10.1, stablecoin ammo is scarce. That scarcity shifts behavior: when capital does move, it moves hard and fast toward utility-layer bets. Solana fits that bill.

With its blazing-fast settlement speed, growing developer ecosystem, and lower cost infrastructure, Solana isn’t just a token, it’s a threat to incumbent rails.

Strategically, this isn’t the moment to chase. It’s the moment to lean in, quietly.

When this coil snaps, it won’t whisper.

Find out why 1M+ professionals read Superhuman AI daily.

In 2 years you will be working for AI

Or an AI will be working for you

Here's how you can future-proof yourself:

Join the Superhuman AI newsletter – read by 1M+ people at top companies

Master AI tools, tutorials, and news in just 3 minutes a day

Become 10X more productive using AI

Join 1,000,000+ pros at companies like Google, Meta, and Amazon that are using AI to get ahead.

The KillChain After Action Report (AAR)

The amateur scammer is dead. Long live the enterprise. Fraud, like any thriving market, demands specialized services, an invisible supply chain that funnels victims into the grinder. This is the blueprint for industrial-scale deception.

$802K Crypto Scam in Metro Atlanta

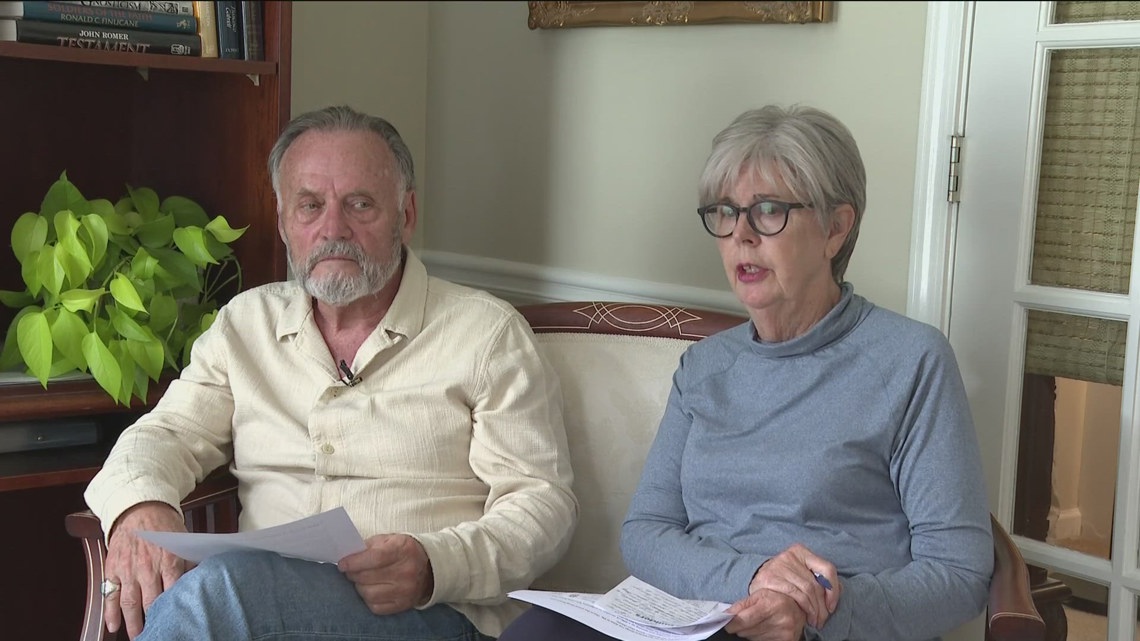

A retired couple in Atlantam Georgia dropped $802,000 of their life savings into what they believed was a legitimate crypto account, after being contacted on WhatsApp. When they tried a final withdrawal, the interface vanished. That money was gone for good.

This wasn’t an amateur operation. It was precision social engineering paired with AI-powered mimicry, deceptive platforms, fake payouts, psychological grooming, and it ended in devastation.

Scam Tactics: Precision Fraudcraft

Phase 1: Trust Architecture

Scammers initiated contact on WhatsApp as “Sophei Van Buren,” referencing legitimate organizations and company details to build credibility.

Employed charm and even flirtation to lower defenses. This wasn’t generic phishing; it was emotional engineering.

Phase 2: Fake Trading Ecosystem

The couple used a real trading interface (CryptoWallet), but the scammer controlled a shadow layer, mirrored balances, withdrawal buttons that evaporated when pressed.

Introduced a polished mobile trading UI, complete with AI-fabricated interfaces that reflected real-time balances.

Provided an illusion of success: “They paid out $20,000 early to establish trust.”

Phase 3: The Extraction

When the couple attempted a major withdrawal, funds vanished. The interface was a ghost site.

$800,000 gone in one moment, with zero recourse and no immediate trace.

Tactical Takeaways for KillChain Readers

WhatsApp is a vector, be suspicious of unsolicited contacts.

Scam starts simple. Ends catastrophic.Test withdrawals from any new platform immediately.

Even after small payouts, push a cashout. If it’s blocked or delayed? Pull.Cross-verify platforms before depositing significant funds.

Check:Registered entity names

Legal presence and licensing

Independent reviews No redress? No deposit.

Know the ‘AI UI trick.’

Real-time balance reflection doesn’t mean real holdings. Don’t mistake visual smoke for capital substance.Emotional grooming = psychological warfare. Emotional manipulation is method, not mistake. Romance, flattery, authority: these are weapons, not coincidences.

KillChain Summary

This wasn’t a “too-good-to-be-true” pump. It was a calculated assassination.

Smart. Well-funded. Built to destroy trust and savings.

But this isn’t just warning. It’s a battle drill:

If you can’t withdraw, you’re hacked.

If someone reaches out as a friend, verify their identity, not just their story.

Crypto security isn’t a checkbox. It’s a mindset. And this couple’s tragedy is proof: when dollars meet romance, infrastructure and emotional line can be exploited in milliseconds.

About the FraudFather:

The Fraudfather didn’t learn fraud from influencers or movies. He learned it chasing terrorists, flipping money launderers, and dismantling multi-million-dollar schemes, before most people knew what “DeFi” meant.

A former Senior Special Agent and Supervisory Intelligence Operations Officer, he spent over two decades tracking financial predators across borders, blockchains, and bureaucracies. From dark web forums to government war rooms, he’s seen every lie and loophole up close.

Now a “recovering” digital identity and cybersecurity executive, he’s turned his sights to teaching crypto, where old scams wear new skins, and smart contracts get played like slot machines.

Through The Fraudfather persona, he’s exposing how fraud really works on-chain:

How social engineers bypass wallet security

How cross-chain laundering pipelines stay hidden

How scammers weaponize human psychology faster than regulators can blink

This isn’t theory.

It’s operational intelligence, on-chain and in near real time.

Follow the Fraudfather and stay five moves ahead of the next exploit.

Fast Facts Regarding the Fraudfather:

Global Adventures: He’s been kidnapped in two different countries—but not kept for more than a day.

Uncommon Encounter: Former President Bill Clinton made him a protein shake.

Unusual Transactions: He inadvertently bought and sold a surface-to-air missile system.

Perpetual Patience: He spent 12 hours in an elevator.

Unique Conversations: He spoke one-on-one with Pope Francis for five minutes using reasonable Spanish.

Uncommon Hobbies: He discussed beekeeping with James Hetfield from Metallica.

Passion for Teaching: He taught teenagers archery in the town center of Kyiv, Ukraine.

Unlikely Math: Until the age of 26, he had taken off in a plane more times than he had landed.