GM. You’re reading KillChain, the tactical brief trusted by digital sleuths, fraud hunters, and crypto insiders who know the real game isn’t DeFi or CeFi; it’s deception.

We track the wallets, decode the scams, and expose the plays fraudsters pray you’ll miss. This isn’t crypto news. It’s threat intelligence. We’re the last line of defense between your protocol and the wolves, your tactical edge in a world where trust is just another exploit.

🎙️ Orange-Pilling Wall Street

If you were hoping for a lazy summer, the market just spiked your espresso:

Wall Street’s gone full degen.

BTC tapped $110 K because BlackRock and Fidelity are inhaling spot-ETF shares like they’re ZYNs.

MicroStrategy? 226,331 BTC and counting; Saylor now weighs less than his wallet.

Ethereum just hit the gym.

Pectra upgrade shaved the queue, fees cooled, and ETH sprinted +15 %. Talk of $15k ETH by Christmas 2025 no longer sounds like choir music from the cult, more like basic math.

*Jerome “Money Printer” Powell may gift-wrap a July rate cut. (But there is a big caveat below)

Cheaper dollars → fatter bids → your bearish neighbor crying in fiat.

The side quests pay too.

Solana keeps stealing users.

AI + Web3 tokens (Render et al.) flash “GPT but make it money.”

Chainlink and XRP are tokenizing everything that isn’t bolted down.

Doge and Bonk prove jokes still outperform your 401(k).

Scammers haven’t taken the weekend off.

Binance face-ID phishers, Iranian exchange hacks, fake Singapore cops; we torch them in The Fuse before they torch you.

*Rate-Cut Fantasy?

In June, the United States kept the job printers moving, wages refuse to crash, and the July “easy-money” dream may have just got rug-pulled.

Payroll Punch

+147,000 jobs in June (Wall Street bet on 110-118 K).

Unemployment dips to 4.1 % (vs. 4.3 % fears).

Caveat: private sector –33k - government hiring and healthcare dragged the total into the green.

Wage Pulse

Paychecks up 0.2 % MoM (tiny miss vs. 0.3 % guess).

3.7 % YoY - slowest in a year, but still hotter than the Fed’s 2 % halo.

Job-stayers snag 4.4 % raises, jumpers bank 6.8 %. Labor isn’t begging yet.

Market Odds

CME FedWatch had a 24 % chance of a July cut on Thursday. Post-report? 5 %.

Translation: Vegas just tore down the “rate-cut coming” billboard.

Fraudfather Take (Though Trump may try to replace Powell)

The Fed traditionally only swings the machete when:

Jobs crack, and

Wages chill to a level that won’t set CPI (inflation) on fire.

June data did neither. So stash the “July pump” hopium; cheap dollars aren’t arriving on schedule. Position sizing: expect higher for longer, hedge any leverage that depends on immediate liquidity rain, and keep the dry powder for the next real panic.

Powell’s message: “Not collapsing? No cuts. Try again in September.”

Tackle your credit card debt by paying 0% interest until nearly 2027

If you have outstanding credit card debt, getting a new 0% intro APR credit card could help ease the pressure while you pay down your balances. Our credit card experts identified top credit cards that are perfect for anyone looking to pay down debt and not add to it! Click through to see what all the hype is about.

New Signal in the KillChain: A Crucial Blind-Spot → Implied-Volatility Heat (IVH)

Code Name: The Rattle Index

Why We Need It

We already track:

MVRV Z-Score (tells us if price is above or below the average holder’s cost)

SOPR (shows whether coins are being spent at a profit or a loss)

Aggregate Funding Pulse (tells us which side of the futures market is paying extra to keep leverage)

Stable-coin Supply Ratio (how much fresh cash ammo is left)

Spot Exchange Net-Flows (where coins are actually moving)

What we don’t measure yet is the market’s forward fear curve; the price people pay today for tomorrow’s volatility.

In the stock market that’s the VIX; in crypto it’s option-implied volatility..

What IVH Measures

A single composite number that captures 30-day “at-the-money” implied volatility across the three busiest option venues (Deribit, Binance, OKX).

To keep it honest, we weight each exchange’s volatility by its open interest; the total number of option contracts that still exist on that venue.

Example of “open-interest-weighted”

Exchange | 30-Day Implied Volatility | Open Interest (Contracts) | Share of Total |

|---|---|---|---|

Derbit | 75% | 40,000 | 40, 000 / 60,000 = 67 % |

Binance | 65% | 15,000 | 15,000 / 60,000 = 25% |

OKX | 90% | 5,000 | 5,000 / 60,000 = 8% |

Composite IVH = (75 % × 67 %) + (65 % × 25 %) + (90 % × 8 %)

≈ 73 % implied volatility

Why weight it? A tiny venue with only 5,000 contracts shouldn’t override a giant venue with 40, 000 contracts. The weighting keeps the final reading anchored to where real money is betting.

How to Read IVH

IVH Level | Intepretation | Plain-English Action |

|---|---|---|

>85% | Options market is paying up for volatility; traders expect big swings. | Tighten stops, consider protective puts, reduce reckless leverage. |

60%-85% | Normal chop priced in; nothing extreme. | Trade normally but stay alert for funding or flow shifts. |

<60% | Complacency; “insurance” (options) is cheap. | Good time to buy calls/puts or size spot positions larger; tail risk is under-priced. |

KillChain Summary

Implied-Volatility Heat adds the missing “fear premium” gauge to our toolkit.

It shows how nervous (or fearless) the options market is, giving us early notice of big swings before they hit spot prices.

With IVH next to MVRV, SOPR, funding, stable-coin ratios, and net-flows, we’ll know:

Who is firing (profit/loss)

How much ammo is left (stable-coins)

How many bullets are borrowed (funding)

And now, how loudly the market is rattling the cage (implied volatility)

Use IVH to size positions, time hedges, and avoid walking into an explosion the options crowd already sees coming. Stay lethal.

"The right to have self-custody of one's private property is a foundational American value that should not disappear when one logs onto the internet. American values of economic liberty, private property rights, and innovation are in the DNA of the DeFi movement."

This isn't a dashboard. This is a tactical briefing, peeling back the layers on the market's core assets.

Battlefield Intelligence: What the Numbers Truly Reveal.

This isn't a dashboard. This is a tactical briefing, peeling back the layers on the market's core assets. We’re watching capital currents, decoding hidden layers, and positioning for the next market swing. Today, we add SSR to MVRV and Netflows for deeper, sharper insight.Use this intelligence to move through the fog of war.

Bitcoin (BTC)

Data cut-off: 3 Jul 2025 @ 07:00 UTC

Signal | Latest Read | Plain-English Tactical Read |

|---|---|---|

MVRV Z-Score | ≈ 2.37 (1 Jul) | Rally remains healthy; two steps below the mania zone. |

Aggregate Funding Pulse | +0.009 % / 8 h | Longs are paying coffee-money fees; confidence, not FOMO. |

Exchange Net-flows (24h) | ≈ –4,300 BTC moved off exchanges | Big wallets keep vacuuming supply; fewer coins left to dump. |

Stable-coin Supply Ratio (SSR) | ≈ 8.1 (BTC mkt cap $2.18 T ÷ stable-coin float $270 B) | Ammo box still light; a fiat inflow is needed for explosive upside. |

Implied-Volatility Heat (IVH) | ≈ 71 % | Market prices in normal-to-elevated swings, no panic premium, no complacency. |

Funding-Rate Spread | Binance +0.006 % vs BitMEX –0.003 % | Bulls pay up on Binance, bears lean in on BitMEX; split crowd = choppy tape. |

KillChain Tactical Readout for BTC:

Calm Confidence – Mid-range MVRV + tiny funding fees = steady bid, no mania.

Float Vacuum – 4k+ BTC drained from exchanges keeps sell walls thin; bulls can move price with less effort.

Ammo Still Scarce – SSR barely budged; without fresh stable-coin capital, expect grind rather than blast-off.

Volatility Neutral – IVH around 71 % says options market sees ordinary turbulence, offering cheap hedges if you need them.

Split Venue Sentiment – Positive fees on Binance, negative on BitMEX warn of whipsaws until one side over-extends.

The KillChain Playbook:

Trim into strength above $110 K. That’s where MVRV will flirt with 3+ and funding can spike.

Reload on fast dips near $100K–$102K. Exchange outflows hint whales are waiting there.

Set an AFP tripwire: +0.10 % with rising open interest. If longs suddenly get pricey, tighten stops, momentum can flip hard.

Use IVH as insurance gauge. IVH < 60 %? Hedge is cheap, grab protective puts. IVH > 85 %? Market already braced, size down leverage instead.

Watch stable-coin float. A jump toward $300 B is your ammo-truck alert; expect velocity when it arrives.

Bottom line:

BTC is still sparring mid-ring, guard up, breathing steady. Float is thinner, nerves are calm, and volatility pricing is neutral. Keep your guard tight and your powder dry.

Ethereum (ETH)

Data cut-off: 3 Jul 2025 @ 07:00 UTC

Signal | Latest Read | Plain-English Tactical Read |

|---|---|---|

MVRV Z-Score | ≈ 0.41 (1 Jul) | ETH has lifted a bit further above cost-basis; still a value pocket, nowhere near bubble levels. |

SOPR (1-Day) | 1.03 | Sellers take coffee-money gains; bid absorbs flow with ease. |

Aggregate Funding Pulse | +0.012 % / 8h | Longs pay a modest premium, confidence edges higher, still shy of FOMO. |

Funding-Rate Spread | Binance +0.012 % vs OKX +0.010 % | Both big venues equally bullish, leverage bias is aligned and mild. |

Exchange Net-flows (7 d) | ≈ –210k ETH pulled from CEXs | Whale vacuum continues; tradable float keeps shrinking. |

Stable-coin Context | $271B global float; ≈ $132B (49 %) lives on Ethereum | Nearly half the ammo already inside ETH’s walls; ready to redeploy instantly. |

Implied-Volatility Heat (IVH) | ≈ 74 % | Options crowd expects normal-to-lively swings; hedging neither cheap nor panic-priced. |

KillChain Tactical Readout for ETH:

Still Undervalued, Slightly Warmer – MVRV at 0.41 shows ETH edging up but far from froth.

Leverage Behaves – Funding fees firm yet small; bulls confident without reckless margin.

Float Tightens Further – Another 210 k ETH disappears into cold wallets—sell pressure lightens.

Ammo in the Castle – $132 B of stables parked on-chain means any risk-on turn can ignite price fast.

Vol Neutral – IVH near mid-70 % says insurance is fairly priced—hedges aren’t expensive, but market isn’t trembling either.

The KillChain Playbook:

Accumulate on quick dips below $2,350. Any pullback that drags MVRV toward zero while net-flows stay negative is a bargain signal.

Trim above $2,750 if funding pops over +0.10 %. A sudden fee spike means longs are crowding—lock profits.

Watch stable-coin float. A $20 B+ jump in USDC/DAI supply is your green-light for the next leg higher.

Use IVH for hedge timing. IVH < 60 %? Options cheap—grab protective puts. IVH > 85 %? Market already hedged—dial back leverage.

Track ETH/BTC ratio. Continued rise = capital rotating down the risk curve; bullish for ETH.

Bottom line:

Ethereum remains the undervalued fortress in a cash-starved battlefield. Whale withdrawals tighten the moat, nearly half the stable-coin ammo sits inside, and leverage is orderly. Load quietly, keep stops sane, and wait for the spark.

Solana (SOL)

Data cut-off: 3 Jul 2025 @ 07:00 UTC

Signal | Latest Read | Plain-English Tactical Read |

|---|---|---|

MVRV Z-Score | ≈ 0.78 (1 Jul) | Still below 1; cheap enough to coil, but warmer than last week. |

SOPR (1-Day) | 1.05 | Holders taking modest profits; no panic exits. |

Aggregate Funding Pulse | +0.014 % / 8h | Longs heating up; confidence rising, not yet frenzy. |

Funding-Rate Spread | Binance +0.015 % vs OKX +0.006 % | Hot money clustering on Binance first; watch for whipsaws. |

Exchange Net-flows (30d) | ≈ –120k SOL since mid-June | Venue float keeps bleeding out, fewer coins to sell. |

Native USDC Mint | +$60M since late May | Extra on-chain ammo, no bridge delay when risk flips on. |

Implied-Volatility Heat (IVH) | ≈ 77 % | Options crowd prices healthy swings; insurance fairly priced. |

KillChain Tactical Readout for SOL:

Launch-Pad Intact – Z-Score below 1 says SOL is still “cheap-enough,” yet warming.

Leverage Heating – Funding fees inch up; longs confident but not overcrowded—still time before blow-off.

Float Vacuum Continues – Another 120k SOL drained from exchanges; a modest demand burst can move price fast.

Ammo in Place – Native-minted USDC now north of $300 M—fuel in the chamber, no cross-chain friction.

Vol Neutral-to-Lively – IVH in the high-70 % range signals normal crypto turbulence—hedges neither dirt-cheap nor panic-priced.

The KillChain Playbook:

Add in small bites between $150–$160. As long as MVRV stays below 1 and AFP under +0.05 %, odds favor upside coil.

Secure partial gains north of $195 if AFP rockets past +0.10 %. Crowded longs can flush fast.

Track native-USDC velocity. If that $300 M starts pouring into DeFi TVL or DEX volume, expect a snap-up.

Watch for a second mega-mint or US-spot-ETF headline. Either is a likely tripwire for breakout.

Use IVH. If IVH drops below 60 %, hedges are cheap; buy calls/puts. If IVH spikes above 90 %, size down leverage; market already braced.

Bottom line:

Solana remains the high-speed rail loaded with fresh fuel while the broader market runs on fumes. Supply keeps tightening, leverage is only warming, and on-chain stable-coin ammo is stacked. When this coil snaps, it will slam, not stroll. Stay loaded, stay lethal.

⚠️ The KillChain Disclaimer ⚠️

Informational & Educational Use Only

All content in this newsletter, including but not limited to market commentary, tactical read-outs, “buy-zone” language, and any linked training materials—is provided strictly for general, educational, and informational purposes. Nothing herein constitutes (or should be interpreted as) personalized investment, legal, accounting, or tax advice.

No Investment Recommendations

References to “accumulate,” “scale in,” “trim,” or similar calls to action are illustrative frameworks, not specific recommendations to buy, sell, or hold any digital asset, security, or derivative. You alone are responsible for evaluating the merits and risks associated with any use of the information provided before making any investment or trading decision. Consult a registered investment adviser or other qualified professional regarding your individual circumstances.

Because the real explosions are the scams you never saw coming.

.Every week we light a short fuse under the latest crypto-fraud headlines—quick blasts that tell you:

What blew up

How the attacker wired the charge (vector in plain English).

Where to see the wreckage (direct link to the source).

Scan the bullets, know the tricks, and yank your funds out of the blast radius before the next detonation.

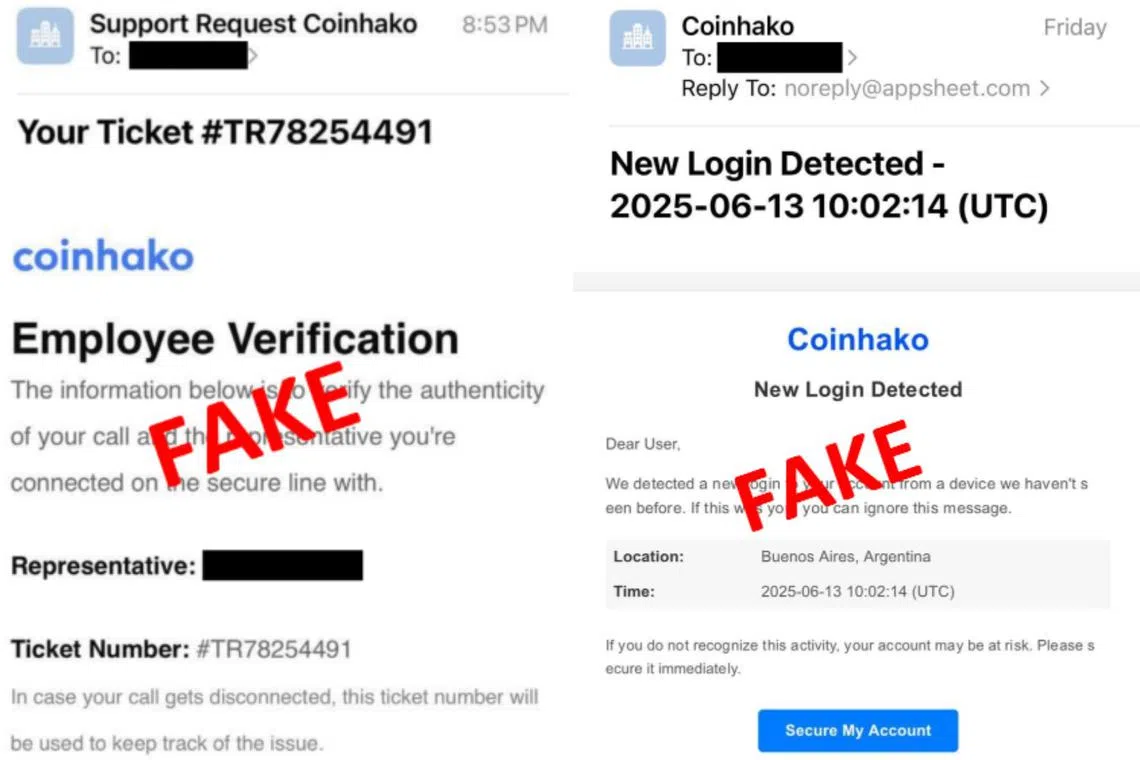

The Fuse – Iran’s $90 M Crypto Wipeout

What Happened

A hack-tivist crew calling itself Predatory Sparrow (widely linked to Israeli cyber ops) breached Iran’s biggest exchange, Nobitex, siphoning or “burning” roughly $90 million in crypto and dumping the platform’s entire source code to the public. The attack followed the group’s same-week takedown of state-owned Bank Sepah and included on-chain messages mocking Iran’s Revolutionary Guard. In short: a geopolitical cyber-strike disguised as an exchange hack.

Why It Matters to Your Wealth

Politics just vaporized customer balances, and Nobitex users had zero say in the cross-fire. If you park coins on a local exchange in a hotspot nation (Iran, Turkey, Argentina, or even a “stable” Western venue) remember: sovereignty risk trumps smart-contract risk. Keep only trading float online; move the treasury to self-custody hardware or multi-sig where one missile or minister can’t rug you overnight. Geopolitics is now a wallet-level threat. Size your exchange exposure like it could be sanctioned or shell-shocked tomorrow. Stay lethal, stay mobile.

The Fuse – “Police Probe” Crypto Con Hits Singapore

What Happened

Fraudsters posing as Singapore police, Interpol agents, or MAS officers cold-call targets and claim their crypto wallets are “implicated in money-laundering.” Victims are ordered to “temporarily transfer” coins to a “secure investigation address” for forensic checks. Once the tokens land, the scammers relay them through mixers and offshore exchanges… gone for good.

Fraud Vector

Pure social-engineering: uniform, badge, and urgency. No malware, no contract exploit, just an official-sounding voice plus a bogus “evidence wallet” QR code.

Why It Matters to Your Wealth

If any “authority” asks you to move assets out of your custody, treat it as hostile; real police freeze funds via the exchange, they don’t send QR codes. Keep a hardware-wallet quarantine zone: coins you never transfer without in-person legal counsel. Remember, the strongest blockchain is useless if you hand the keys to someone in a fake uniform. Stay lethal, stay skeptical.

The Fuse – 40+ Malicious Firefox Extensions Hijack Wallets

What Happened

Mozilla removed 46 rogue Firefox add-ons masquerading as utilities (“Search Enhancer,” “PDF Converter,” “Price Tracker”) that secretly injected JavaScript into every site you visited. Once a victim opened Gmail, an exchange, or a browser-based wallet (MetaMask, Phantom, Rabby), the code scraped session cookies and seed phrases, then shipped them to a hard-coded Telegram bot controlled by the attackers.

Fraud Vector

Supply-chain infiltration: users granted full browser permissions to an extension that looked benign. No phishing link needed; the malware waited for you to log in and siphoned tokens silently.

Why It Matters to Your Wealth

Browser extensions are the new hot wallet back-door. Treat every add-on like a potential keylogger and follow a two-tier rule:

Trading PC ≠ Browsing PC. Keep Web3 logins on a stripped-down browser profile with zero extra extensions.

Hardware-sign or stay offline. If a seed phrase ever appears in a browser field, assume it’s already compromised.

One bad extension can ghost-drain every wallet you own. Audit your add-ons now, delete the fluff, and lock critical signing to hardware. Stay lethal, stay stateless.

The KillChain After Action Report (AAR)

About the FraudFather:

The Fraudfather didn’t learn fraud from influencers or movies. He learned it chasing terrorists, flipping money launderers, and dismantling multi-million-dollar schemes, before most people knew what “DeFi” meant.

A former Senior Special Agent and Supervisory Intelligence Operations Officer, he spent over two decades tracking financial predators across borders, blockchains, and bureaucracies. From dark web forums to government war rooms, he’s seen every lie and loophole up close.

Now a “recovering” digital identity and cybersecurity executive, he’s turned his sights to teaching crypto, where old scams wear new skins, and smart contracts get played like slot machines.

Through The Fraudfather persona, he’s exposing how fraud really works on-chain:

How social engineers bypass wallet security

How cross-chain laundering pipelines stay hidden

How scammers weaponize human psychology faster than regulators can blink

This isn’t theory.

It’s operational intelligence, on-chain and in near real time.

Follow the Fraudfather and stay five moves ahead of the next exploit.

Fast Facts Regarding the Fraudfather:

Global Adventures: He’s been kidnapped in two different countries—but not kept for more than a day.

Uncommon Encounter: Former President Bill Clinton made him a protein shake.

Unusual Transactions: He inadvertently bought and sold a surface-to-air missile system.

Perpetual Patience: He spent 12 hours in an elevator.

Unique Conversations: He spoke one-on-one with Pope Francis for five minutes using reasonable Spanish.

Uncommon Hobbies: He discussed beekeeping with James Hetfield from Metallica.

Passion for Teaching: He taught teenagers archery in the town center of Kyiv, Ukraine.

Unlikely Math: Until the age of 26, he had taken off in a plane more times than he had landed.