Congress votes, CPI hits, and ETF greenlights converge... this is the fuse that could rewrite every chart you trade.

GM. You’re reading KillChain, the tactical brief trusted by digital sleuths, fraud hunters, and crypto insiders who know the real game isn’t DeFi or CeFi; it’s deception.

We track the wallets, decode the scams, and expose the plays fraudsters pray you’ll miss. This isn’t crypto news. It’s threat intelligence. We’re the last line of defense between your protocol and the wolves, your tactical edge in a world where trust is just another exploit.

🎙️ Buckle up, July 14 isn’t just another turn of the calendar, it’s a live-fire exercise.

The U.S. Congress is about to vote on three marquee crypto bills, the SEC will lock in spot-ETH ETF paperwork, and Tuesday’s CPI print could yank the Fed from “higher-for-longer” to “cut-the-checks.” All this while Bitcoin sits at a fresh all-time high, Binance is loaded with a record $31 billion in stablecoin ammo, and the Stablecoin Supply Ratio MACD has flipped green, an on-chain flare that new money is itching to deploy.

In short: policy, macro, and liquidity are lining up like a firing squad. Position early, hedge the shock points, and keep your finger off the trigger until the first headline drops. This is the week where narratives get rewritten and portfolios get re-priced; stay lethal or stay sidelined.

What’s on the Radar for Crypto Week: July 14 → July 20, 2025

Date | Catalyst | Why It Matters |

|---|---|---|

Mon 14 Jul - Fri 18 Jul | “Crypto Week” on the U.S. House floor | First time Congress takes up a full crypto package. Passage = green-light for U.S.-based issuers, banks and funds; failure = headline risk. |

Tue 15 Jul - 08:30 ET | U.S. CPI (June) | Forecast 2.4 % YoY. A soft print pushes rate-cut odds back up; a surprise pop kills the “easy-liquidity” bid. |

Wed 17 Jul (SEC deadline) | Final S-1 filings for spot-Ethereum ETFs | Issuers must lock fees and prospectus wording. Clean filings = trading launch still on track for 23 Jul; last-minute hitches spook ETH bulls. |

All Week | SSR-MACD just flashed bullish | Momentum indicator shows stable-coin cash finally flowing back on-chain → supports BTC’s new ATH move. |

Liquidity backdrop | • Binance reserves hit $31 B USDT/USDC (record) → dry powder | Whales remain in charge; any CPI-driven dip likely met with size. |

Regulatory Watch | SEC pushing issuers to re-file Solana ETFs by end-July; guidance or leaks during Crypto Week could jolt SOL. | The SEC’s July re-filing deadline tees up a potential Solana spot-ETF launch before October, handing institutions a direct on-ramp to SOL just as they got for BTC and (soon) ETH. If approved, it turns a DeFi speed-rail into Wall Street’s next regulated playground; fuel for fresh capital and a new price-discovery leg. |

Macro Backdrop | Fed governor Waller broke ranks, backing a July rate cut; still low odds (≃ 5 %), but any dovish chatter after CPI adds fuel. | Fed governor Christopher Waller,usually a hawk,just signaled he’s open to near-term rate cuts, hinting the Fed’s “higher for longer” stance is cracking. Cheaper dollars would reload liquidity cannons, turbo-charging risk assets from Bitcoin to high-beta tech. |

Tactical Frame for the Week

BTC: Price discovery above $118.6 K + bullish SSR-MACD = room to extend toward the $118K-$120K magnet if CPI is tame and House bills progress.

ETH: Spot-ETF pipeline is the driver. Clean S-1 filings on the 17th could trigger a pre-launch run at $2.9 K–$3 K; any SEC foot-dragging likely caps rallies.

SOL: Watch for ETF chatter and the growing native-USDC pile (~$360M). A headline pop during Crypto Week can finally pop the $195 ceiling.

Volatility: 30-day IV remains ~70 % for majors; hedges still cheap relative to fresh ATHs. Consider protective calls/puts into Tuesday’s CPI print.

Legislative tape bombs: Floor-vote roll calls drop intra-day; algo headlines can goose or gut sentiment. Keep a news feed on Capitol Hill proceedings.

Actionable Prep

Calendar-hedge Tuesday 15 Jul (CPI): straddle/strangle or tight stops.

Watch House C-SPAN feed: a surprise delay or hostile amendment to GENIUS or CLARITY is your risk-off trigger.

Liquidity tell: if Binance stable-coin reserves shrink > $2B while price stalls, assume smart money is de-risking.

ETH options: consider short-dated call spreads into 23 Jul ETF go-live; volatility likely reprices.

Bottom Line

July 14 kicks off the most policy-heavy week U.S. crypto has ever seen; simultaneously landing a CPI print that could revive Fed-cut bets. Whales are liquid, retail is quiet, and legislators have the mic. Trade the headlines, hedge the macro, and stay lethal.

New Signal in the KillChain: Stable-Coin Supply Ratio MACD (SSR-MACD)

Code Name: The Ammo Radar

Why We Need It

We already know how much “gunpowder” sits on the sidelines with the Stablecoin Supply Ratio (SSR)

SSR = Bitcoin Market-Cap ÷ Aggregate Stable-Coin Float (USDT + USDC + DAI …)

Lower SSR ⇒ more ammo; higher SSR ⇒ magazine running dry.

Great! but SSR is a static snapshot. What we’re still missing is a momentum gauge that tells us when the ammo truck is actually rolling toward the frontline.

What SSR-MACD Measures

We bolt a classic Moving-Average Convergence-Divergence (MACD) engine onto SSR:

SSR-MACD = 12-day EMA of SSR - 26-day EMA of SSR

Signal Line = 9-day EMA of the SSR-MACD

Histogram = SSR-MACD - Signal Line

Bullish crossover: SSR-MACD line pops above its Signal Line

↳ Ammo momentum flips positive; fresh stable-coins likely to deploy.Bearish crossover: SSR-MACD line drops below its Signal Line

↳ Dry-up warning; sidelined cash losing interest.

Quick Visual Example

Date | Raw SSR | 12-Day EMA | 26-Day EMA | SSR-MACD | Signal Line | Histogram |

|---|---|---|---|---|---|---|

July 1 | 8.5 | 8.62 | 8.74 | -.0.12 | -0.10 | -0.02 |

July 5 | 8.3 | 8.46 | 8.64 | -0.18 | -0.13 | -0.05 |

July 9 | 7.9 | 8.09 | 8.38 | -0.29→-0.05 crossover | -0.08 | +0.03 |

Histogram flips from red to green → bullish crossover → ammo truck spotted.

How to SSR-MACD

Signal Flash | Intepretation | Plain-English Action |

|---|---|---|

Bullish crossover | Fresh stablecoins gearing up; liquidity wave inbound. | Lean long on dips, widen upside targets, tighten trailing stops instead of hard exits. |

Bullish expansion | Ammo flow accelerating. | Let winners run; avoid early profit-taking. |

Bearish crossover | Liquidity momentum stalling; dry season ahead. | Reduce leverage, harvest partial gains, prepare for grind or pullback. |

Bearish expansion | Capital exiting; rally fuel spent. | Tighten stops hard, consider hedges or short-vol plays. |

KillChain Summary

SSR-MACD = Doppler radar for stablecoin liquidity.

Raw SSR says how much ammo exists; SSR-MACD tells us when it’s marching onto (or off) the field.

With SSR-MACD beside MVRV, SOPR, AFP, IVH, and Net-Flows, we now track:

Who’s shooting (profit/loss)

How many bullets are left (SSR)

How fast new bullets are arriving (SSR-MACD)

How many rounds are borrowed (funding)

And how loud the market’s heartbeat is (IVH)

Use SSR-MACD crossovers to pre-position before the herd, avoid dry-powder traps, and ride fresh liquidity instead of chasing it.

“After years of dedicated work in Congress on digital assets, we are advancing landmark legislation to establish a clear regulatory framework for digital assets that safeguards consumers and investors, provides rules for the issuance and operation of dollar-backed payment stablecoins, and permanently blocks the creation of a Central Bank Digital Currency (CBDC) to safeguard Americans' financial privacy.”

This isn't a dashboard. This is a tactical briefing, peeling back the layers on the market's core assets.

Battlefield Intelligence: What the Numbers Truly Reveal.

This isn't a dashboard. This is a tactical briefing, peeling back the layers on the market's core assets. We’re watching capital currents, decoding hidden layers, and positioning for the next market swing. Today, we add SSR to MVRV and Netflows for deeper, sharper insight.Use this intelligence to move through the fog of war.

Bitcoin (BTC)

Data cut-off: 10 Jul 2025 @ 07:00 UTC

Signal | Latest Read | Plain-English Tactical Read |

|---|---|---|

Spot Price | $118.6k new ATH (all-time high) | Price discovery mode: every tick is fresh sky. |

MVRV Z-Score | ≈ 2.75 (9 Jul) | Rally edging toward “frothy,” but not blow-off (needs > 3.5). |

Aggregate Funding Pulse | +0.018 % / 8h | Longs paying “lunch-plus” fees, confidence hot, flirting with FOMO. |

Exchange Net-flows (24h) | ≈ –5,900 BTC moved off exchanges | Whale vacuum stronger; sell walls wafer-thin. |

Stable-coin Supply Ratio (SSR) | ≈ 7.5 (BTC mkt cap $2.28 T ÷ stable-coin float $304 B) | Box just got heavier; fresh fiat clearly arriving. |

SSR-MACD | Bullish Crossover | Liquidity momentum flipped positive; historically precedes new inflows. |

Implied-Volatility Heat (IVH) | ≈ 72 % | Options crash helmets still affordable; no panic premium. |

Funding-Rate Spread | Binance +0.017 % vs BitMEX –0.004 % | Bulls now rule both venues; watch for overextension whips. |

KillChain Tactical Readout for BTC:

Liquidity Ignition - SSR drops to 7.5 and SSR-MACD flips green; stable-coin inflow confirmed.

Confidence Heating - Funding fees edge up but stay sub-0.02 %; still room before leverage flash-points.

Float at Vacuum Level 4 - Nearly 6 k BTC yanked from exchanges; every fresh bid cuts deeper.

Insurance Still Fair - IVH at 72 % keeps hedges reasonably priced, even mid-breakout.

All Venues Lean Long - Binance & BitMEX both positive; upside momentum strong but whipsaw risk grows.

The KillChain Playbook:

Harvest strength into $117K–$120K if funding breaks > 0.025 % and MVRV prints 3+. Parabolic odds rise there.

Reload $105K–$107K on news-flash dips. Whale cold-storage cues say deep bids lurk.

SSR-MACD Watch: Bullish cross confirmed; if SSR keeps falling toward 7.0 with price flat, expect next leg.

AFP Tripwire: Funding ≥ +0.10 % and open-interest surge = tighten stops, liquidations can flip momentum.

IVH Gauge: IVH < 60 % → cheap hedges, grab puts/calls; IVH > 90 % → market braced, reduce leverage.

Bottom line:

BTC tore up to $118.6K, whales are hoarding, and stable-coin ammo just rolled in; market has fuel for another push. Stay nimble: trim euphoria spikes, reload controlled pullbacks, and watch funding like a hawk. Guard tight, powder dry, aim forward.

Ethereum (ETH)

Data cut-off: 10 Jul 2025 @ 07:00 UTC

Signal | Latest Read | Plain-English Tactical Read |

|---|---|---|

Spot Price | $2,680 intraday high | Post-Pectra grind continues; highest close since April. |

MVRV Z-Score | ≈ 0.59 ( 9 Jul) | ETH has climbed further above cost basis yet sits miles below euphoric territory. Still “value with traction.” |

SOPR (1-Day) | 1.04 | Sellers skim latte-money gains; buy-side absorbs flow with ease. |

Aggregate Funding Pulse | +0.018 % / 8h | Leverage warming; bulls pay up but haven’t hit FOMO rates. |

Funding-Rate Spread | Binance +0.018 % vs OKX +0.015 % | All major venues in sync; long bias strong and unified. |

Exchange Net-flows (7 d) | ≈ –125k ETH off exchanges | Whale siphon continues; float keeps thinning. |

Stable-coin Context | $304B global float; ≈ $149B (49 %) lives on Ethereum | On-chain ammo pile grew ~$17 B in a week; liquidity primed. |

Implied-Volatility Heat (IVH) | ≈ 72 % | Options pricing “normal crypto churn”; hedges still reasonably priced. |

ETH/BTC Ratio | 0.0239 (creeping up) | Capital rotating down the risk curve; the Fraudfather is bullish for ETH. |

KillChain Tactical Readout for ETH:

Value With Momentum - MVRV 0.59 > 0.41 last week: still cheap, now moving.

Leverage Heating, Not Boiling - Funding < 0.02 % keeps bulls comfy, margin not reckless.

Supply Dryer - Another 125k ETH vacuumed off exchanges; each bid pushes harder.

Ammo Inside the Walls - On-chain stable-coin pile up $17 B: liquidity can ignite without bridges.

Insurance Fair - IVH 72% means protective options affordable; market not bracing for shock.

Rotation Signal - ETH/BTC uptick shows fresh capital sliding into ETH.

The KillChain Playbook:

Accumulate on dips under $2,550. Any pullback dragging MVRV toward 0.3 while net-flows stay negative = bargain reload.

Trim above $2,850 if funding spikes past +0.025 %. Fee surge = longs crowding; bank profits.

Watch stable-coin float. Another $15–20 B jump in USDC/DAI supply is your green light for $3k breakout.

Use IVH for hedge timing. IVH < 60 % → cheap puts/calls; IVH > 85 % → market hedged; dial back leverage.

Monitor ETH/BTC ratio. Continued climb confirms rotation; falling ratio warns BTC sucking oxygen.

Bottom line:

Ethereum remains the undervalued fortress, but the drawbridge is lifting. More stables inside, whales hoarding, leverage still sane. Load quietly, respect funding spikes, and be ready for the castle to fire its cannons.

Solana (SOL)

Data cut-off: 10 Jul 2025 @ 07:00 UTC

Signal | Latest Read | Plain-English Tactical Read |

|---|---|---|

Spot Price | $178 intraday | Still lodged in the $170-$180 coil zone; no breakout yet, but pressure building. |

MVRV Z-Score | ≈ 0.95 (9 Jul) | Almost at parity with on-chain cost; cheap enough to spring, but far from mania. |

SOPR (1-Day) | 1.06 | Holders skim modest profits; no one rushing for the exit. |

Aggregate Funding Pulse | +0.018 % / 8h | Leverage warming; confidence rising, still shy of frenzy. |

Funding-Rate Spread | Binance +0.019 % vs OKX +0.009 % | Hot money clusters on Binance first, whipsaw risk if funding spikes. |

Exchange Net-flows (30d) | ≈ –150k SOL pulled since mid-June | Venue float keeps bleeding; fewer coins left to dump. |

Native USDC Mint | +$110M since late May | Extra on-chain ammo, no bridge friction when risk flips on. |

Implied-Volatility Heat (IVH) | ≈ 75 % | Options crowd prices healthy swings; insurance fairly priced. |

KillChain Tactical Readout for SOL:

Launch-Pad Still Set - MVRV < 1 keeps SOL in “value-with-potential” territory.

Leverage Heating - Funding fees creep higher but remain sub-0.02 %; longs confident, not reckless.

Float Vacuum Deepens - 150 k SOL yanked off exchanges tightens supply; small demand burst can punch price.

Ammo in the Chamber - Native-minted USDC now at ~$360M; fuel ready for instant deployment.

Vol Neutral-to-Lively - IVH mid-70 % = ordinary turbulence; insurance fairly priced.

The KillChain Playbook:

Add in bites between $165–$172. MVRV < 1 + funding < 0.05 % = favorable risk/reward.

Trim north of $195 if funding pops > 0.025 %. Crowded longs can flush fast.

Watch native-USDC velocity. If that $360 M starts flowing into DeFi TVL or DEX volume, expect a snap-up.

Monitor headlines: another mega-mint or U.S. spot-ETF rumor is a likely breakout tripwire.

IVH trigger: IVH < 60 %? Cheap hedges; buy calls/puts. IVH > 90 %? Size down leverage; market already braced.

Bottom line:

Solana is still the high-speed rail running on fresh stable-coin fuel while broader markets look for direction. Supply keeps tightening, leverage is only warming, and on-chain ammo is stacked. When this coil snaps, it will slam, not stroll. Stay loaded, stay lethal.

⚠️ The KillChain Disclaimer ⚠️

Informational & Educational Use Only

All content in this newsletter, including but not limited to market commentary, tactical read-outs, “buy-zone” language, and any linked training materials—is provided strictly for general, educational, and informational purposes. Nothing herein constitutes (or should be interpreted as) personalized investment, legal, accounting, or tax advice.

No Investment Recommendations

References to “accumulate,” “scale in,” “trim,” or similar calls to action are illustrative frameworks, not specific recommendations to buy, sell, or hold any digital asset, security, or derivative. You alone are responsible for evaluating the merits and risks associated with any use of the information provided before making any investment or trading decision. Consult a registered investment adviser or other qualified professional regarding your individual circumstances.

Because the real explosions are the scams you never saw coming.

.Every week we light a short fuse under the latest crypto-fraud headlines; quick blasts that tell you:

What blew up

How the attacker wired the charge (vector in plain English).

Where to see the wreckage (direct link to the source).

Scan the bullets, know the tricks, and yank your funds out of the blast radius before the next detonation.

The Fuse – “Test Our App, Lose Your Wallet” Scam

What Happened

A professional-grade con ring is parading as hot new “AI/Web3” start-ups on X/Twitter. Using hijacked, blue-check handles, they DM followers with a too-good-to-be-true offer: “We’ll pay you 300 USDC to beta-test our app.”

Victims who bite download a polished Windows Electron installer or macOS DMG, actually the Realst/Atomic Stealer. The malware:

Profiles the machine, bypassing AV with stolen code-signing certs.

Rips browser data, seed phrases, and wallet files.

ZIPs the haul and exfiltrates it to a command server within seconds.

Your balances hit zero before the fake Cloudflare spinner even finishes.

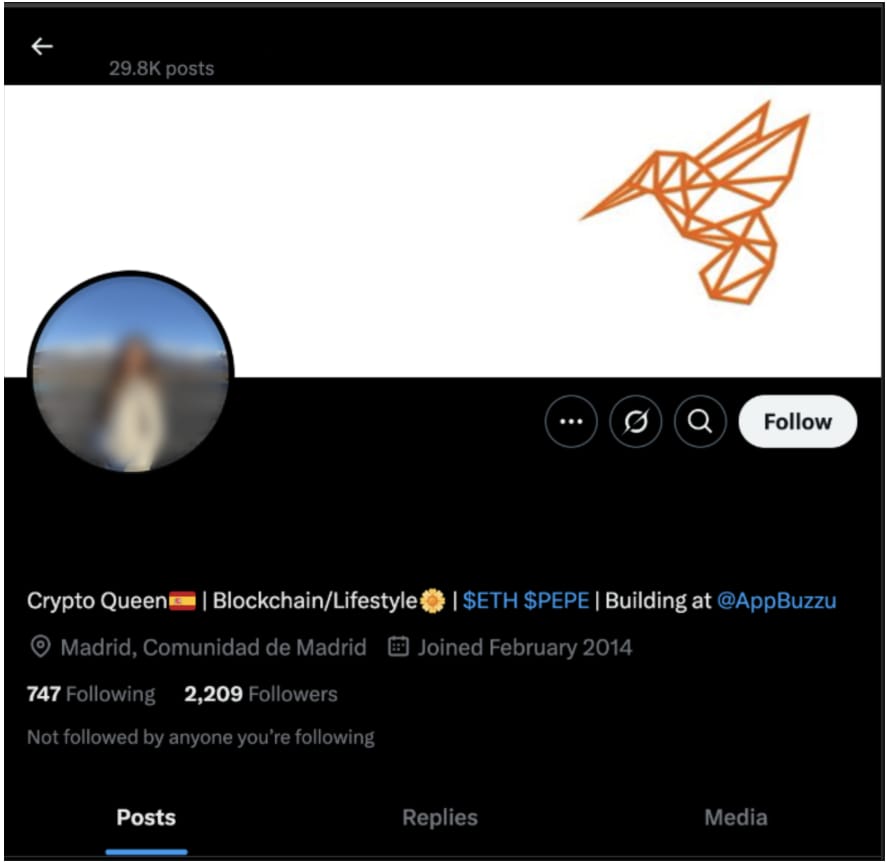

Example of a compromised X account to create a “BuzzuAI” employee. Credit: Darktrace

The Fake Companies

“Company” | Social Handles (X) | Front-End Domains |

|---|---|---|

Pollens AI | @pollensapp, @Pollens_app | pollens[.]app/ pollens[.]tech |

Buzzu | @BuzzuApp, @AI_Buzzu | buzzu[.]app/buzzu[.]me |

Swox | @SwoxApp, @Swox_AI | swox[.]io/swox[.]app |

Eternal Decay | @metaversedecay | eternal-decay[.]xyz |

Cloudsign | @cloudsignapp | cloudsignapp[.]com* (redirect) |

Wasper/BeeSync | @wasperAI, @BeeSyncAI | wasper[.]app/ |

Slax | @SlaxApp, @slaxproject | slax[.]tech/slax[.]social |

Solune | @soluneapp | solune[.]io |

All flush with Medium posts, Notion roadmaps, GitHub repos (stolen OSS code re-labelled), even Photoshopped “conference” pics.

Example of threat actor messaging a victim on X with a registration code.

Who is Behind the Mask?

Meet the “traffer” cartel, cyber crews that run traffic like drug mules. Their job: herd users onto poisoned links, slip info-stealer malware onto machines, and flip stolen seeds on dark-market shelves. One of the biggest outfits, CrazyEvil, was unmasked this year: a tiered syndicate with recruiters, affiliate “drivers,” and a factory line of fake AI/Web3 brands.

CrazyEvil’s playbook, now copied by look-alike crews in this week’s campaign, goes like this:

Spin up a shiny start-up on Twitter, Medium, and GitHub (complete with whitepaper and doctored conference selfies).

DM crypto traders and DeFi devs: “Test our new app, get 300 USDC.”

Installer = Realst/Atomic Stealer. Works on Windows and macOS, signed with stolen certs.

Exfil. Cash-out. Vanish. Millions siphoned, credentials auctioned on private marketplaces.

Whether this exact sting is CrazyEvil or a copycat, the tactics are a carbon copy: corporate cosplay + SEO + weaponized downloads. The takeaway: if a brand-new “AI” company wants you to run their installer for quick crypto, they’re not pitching, they’re picking your pocket

Attack Chain

Trusted social DMs → slick website & docs → trojanized “beta app” → Realst/Atomic Stealer → wallet drain.

Why It Matters to Your Wealth

Paid beta tests are never paid in these schemes. They’re a buyout of your private keys.

DMG/Electron + wallets = Russian roulette. Keep a burner laptop for unknown software; never mix with signing hardware.

Polish ≠ legitimacy. The shinier the deck, the sharper the knife.

One impulsive click turns your holdings into their exit liquidity. Sandbox, verify, or just ghost-reply: “I’ll test your app when hell freezes over.”

Stay lethal, stay skeptical.

Orginal Story:

About the FraudFather:

The Fraudfather didn’t learn fraud from influencers or movies. He learned it chasing terrorists, flipping money launderers, and dismantling multi-million-dollar schemes, before most people knew what “DeFi” meant.

A former Senior Special Agent and Supervisory Intelligence Operations Officer, he spent over two decades tracking financial predators across borders, blockchains, and bureaucracies. From dark web forums to government war rooms, he’s seen every lie and loophole up close.

Now a “recovering” digital identity and cybersecurity executive, he’s turned his sights to teaching crypto, where old scams wear new skins, and smart contracts get played like slot machines.

Through The Fraudfather persona, he’s exposing how fraud really works on-chain:

How social engineers bypass wallet security

How cross-chain laundering pipelines stay hidden

How scammers weaponize human psychology faster than regulators can blink

This isn’t theory.

It’s operational intelligence, on-chain and in near real time.

Follow the Fraudfather and stay five moves ahead of the next exploit.

Fast Facts Regarding the Fraudfather:

Global Adventures: He’s been kidnapped in two different countries—but not kept for more than a day.

Uncommon Encounter: Former President Bill Clinton made him a protein shake.

Unusual Transactions: He inadvertently bought and sold a surface-to-air missile system.

Perpetual Patience: He spent 12 hours in an elevator.

Unique Conversations: He spoke one-on-one with Pope Francis for five minutes using reasonable Spanish.

Uncommon Hobbies: He discussed beekeeping with James Hetfield from Metallica.

Passion for Teaching: He taught teenagers archery in the town center of Kyiv, Ukraine.

Unlikely Math: Until the age of 26, he had taken off in a plane more times than he had landed.