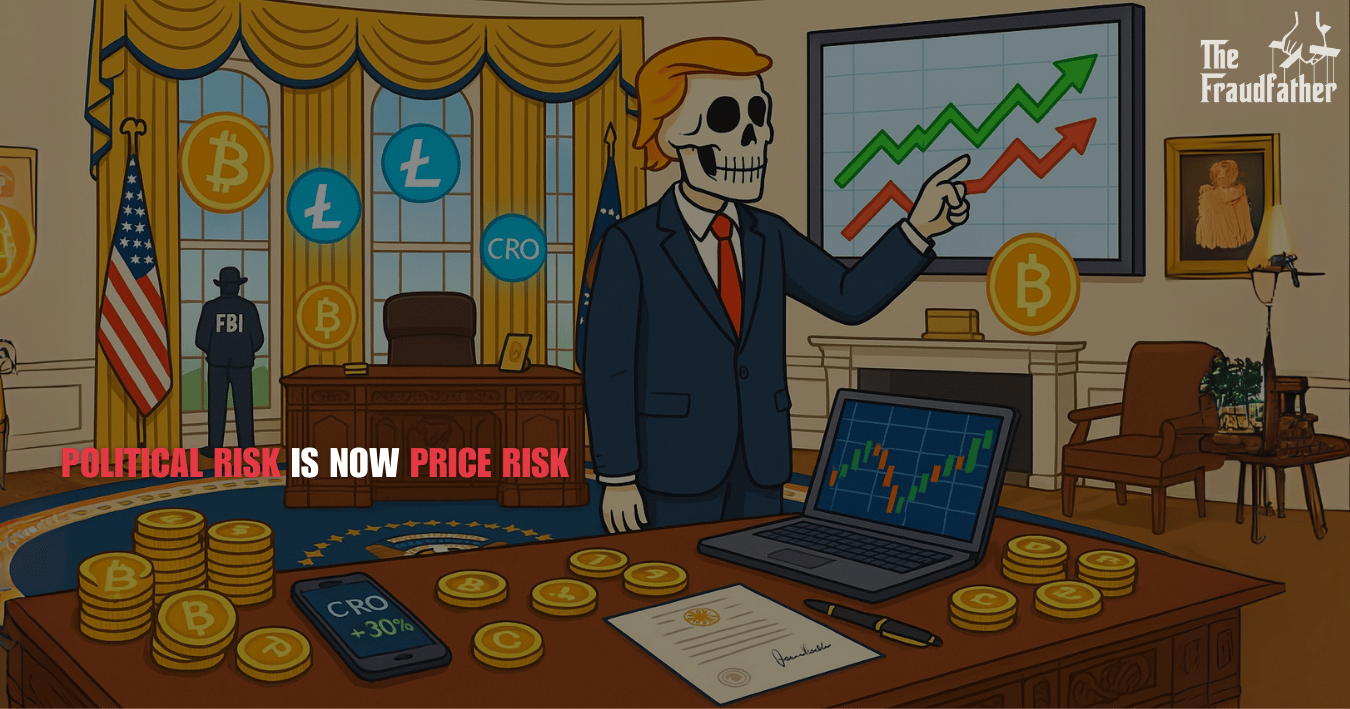

When Constitutional Conflicts Meet Digital Assets, Your Portfolio Becomes a Political Weapon

The Presidential Pump: How Trump Turned the Oval Office Into a Crypto Trading Floor

When Constitutional Conflicts Meet Digital Assets, Your Portfolio Becomes a Political Weapon

GM. You're reading The KillChain, where we decode the schemes that separate smart money from the marks. Today's briefing isn't just about crypto, it's about what happens when the most powerful office in the world becomes a market-moving force in digital assets.

While you were tracking whale movements and DeFi yields this week, the President of the United States just executed the most audacious crypto play in political history. Trump Media announced a $6.42 billion partnership with Crypto.com to create America's largest CRO treasury company, with Trump Media buying $105 million in CRO tokens while Crypto.com invests $50 million in DJT stock.

This isn't just another corporate treasury play. This is the sitting President of the United States directly profiting from cryptocurrency price movements while wielding the regulatory power to influence those same markets. The implications for crypto investors, and American democracy, are staggering.

The Deal Structure: A Masterclass in Political-Financial Engineering

Let's dissect exactly what happened here, because the financial mechanics reveal a level of sophistication that should terrify anyone who understands both markets and power.

The Trump Media Group CRO Strategy will be initially seeded with $1 billion in CRO (6,313,000,212 tokens, representing ~19% of the total CRO market cap), $200 million in cash, $220 million in mandatory exercise warrants, plus an additional $5 billion equity line of credit from Yorkville. The new entity will trade under the ticker "MCGA" (Make CRO Great Again).

But here's where it gets interesting from a market manipulation perspective: Trump Media will custody and stake its CRO holdings with Crypto.com for additional revenue, while Crypto.com provides the digital wallet infrastructure for Truth Social's rewards system. This creates multiple revenue streams all flowing back to the President's media empire.

The timing? CRO surged 30% immediately following the announcement, even as the broader cryptocurrency market slipped this week. That's a $300+ million paper gain on the Trump Media position within hours of the announcement.

Translation for KillChain readers: The President of the United States just demonstrated he can move crypto markets with executive announcements. Your trading strategies now need to factor in presidential tweet risk.

The Constitutional Crisis Hiding in Plain Sight

Here's what mainstream crypto media isn't telling you: This arrangement creates unprecedented conflicts of interest that make the old debates about presidential business interests look quaint.

The Regulatory Capture Problem: Trump's administration controls the SEC, CFTC, Treasury Department, and every other agency that regulates cryptocurrency. Since taking office, the Trump administration has pushed for crypto-friendly regulations and laws, while the Trump family has aggressively sought to expand its crypto-related businesses. Now the President has direct financial incentive to ensure CRO-favorable regulatory outcomes.

Consider the math: If regulatory clarity boosts CRO from $0.20 to $0.30 (a modest 50% gain), Trump's position gains $50+ million in value. That's not pocket change, that's policy-influencing money.

The Market Manipulation Dynamic: Every presidential statement, executive order, or regulatory hint now carries dual meaning. When Trump talks about crypto policy, is he speaking as President or as a major CRO stakeholder? The unprecedented dynamic has led to allegations of corruption from Democrats, though the president says he has entrusted the management of his business dealings to his sons.

The "trust me, my sons are handling it" defense doesn't address the fundamental issue: Trump's personal wealth is now directly tied to one specific cryptocurrency's performance.

The Technical Execution: Why This Model is Brilliant and Dangerous

From a pure financial engineering perspective, this deal represents evolution in the corporate treasury playbook pioneered by Michael Saylor. But it's the political overlay that makes it revolutionary.

The Staking Flywheel: The company will become the world's largest holder of CRO with around 6.3 billion tokens, valued at roughly $1 billion at the time of announcement, with the mission to maximize what Crypto.com CEO called a "flywheel effect" involving raising funds to acquire more CRO.

Unlike MicroStrategy's Bitcoin strategy, this creates multiple interlocking mechanisms:

Truth Social rewards paid in CRO

Platform subscriptions payable in CRO

Staking rewards from the massive treasury position

Political influence to ensure regulatory favorability

The Network Effect: Users will be able to convert platform "gems" into CRO and pay for subscriptions using CRO balances, with both companies co-marketing Truth+ and Crypto.com wallet services. This isn't just treasury accumulation, it's ecosystem capture.

Truth Social has limited users today, but imagine if government contractors need Truth+ subscriptions to access federal communications channels. Suddenly, CRO becomes embedded in the federal procurement process.

The Precedent That Changes Everything

This isn't just about one deal or one token. Trump just established that sitting presidents can directly profit from cryptocurrency investments while wielding regulatory authority over those same assets.

What This Means for Other Tokens: If presidential involvement can pump CRO 30% in hours, what happens when Trump mentions Bitcoin? Ethereum? Any other digital asset? Donald and Melania Trump launched memecoins early this year, $TRUMP and $MELANIA, although both are well off their highs. His sons Donald Jr. and Eric have a crypto venture called World Liberty Financial.

The Trump family now has financial interests across multiple crypto verticals. Your portfolio isn't just subject to Fed policy anymore, it's subject to Trump family business strategy.

The International Implications: Cronos is positioned to integrate seamlessly with U.S. financial infrastructure through Crypto.com's global infrastructure and strategic partnerships with payment processors and other financial services platforms. This partnership potentially gives a Singapore-based exchange (Crypto.com) unprecedented access to U.S. government-related transactions.

Foreign policy decisions involving Singapore, Hong Kong, or broader Asian financial markets now carry potential conflicts of interest. How do you conduct independent monetary policy when the President's wealth depends on a specific exchange's success?

The Market Intelligence: What Smart Money is Already Doing

While retail investors debate the ethics, institutional players are adapting to the new reality. Here's what Fraudfather sources are reporting:

Hedge Fund Positioning: Several major crypto funds have quietly accumulated CRO positions since mid-August, anticipating exactly this type of political catalyst. The smart money recognized that Trump's crypto interests would eventually create systematic advantages for tokens with direct family connections.

Corporate Treasury Recalculation: The deal marks the second Trump-linked crypto treasury entity and puts CRO as the latest crypto to be adopted in the digital asset treasury trend that has become popular in corporate America. CFOs are now asking: "If the President's company is buying this token, should we be too?"

Exchange Flow Dynamics: CRO trading volume spiked 700% in the 24 hours following the announcement. But more tellingly, the majority of new CRO accumulation is happening through institutional-size transactions, not retail FOMO. Professional money is positioning for sustained political advantage.

The Questions Nobody is Asking (But Should Be)

Regulatory Capture: How do you maintain independent financial regulation when regulators serve a President with massive cryptocurrency holdings? If CRO faces regulatory challenges, can the SEC provide impartial enforcement?

National Security: Crypto.com is based in Singapore and has faced scrutiny over compliance practices. Should a sitting U.S. President have financial partnerships with foreign-controlled crypto exchanges? What happens to this arrangement if U.S.-Singapore relations deteriorate?

Succession Planning: What happens to these positions if Trump leaves office? Does the next administration have to manage inherited presidential crypto portfolios? Could future presidents be incentivized to manipulate crypto markets for personal gain?

Market Stability: Trump Media and Crypto.com working together to expand access to the benefits and opportunities of crypto, aiming to make CRO the utility token of choice globally. If a token becomes integral to government operations, does it become "too big to fail"? Would taxpayers end up bailing out presidential crypto investments?

Your Tactical Response: How to Profit from Political-Crypto Convergence

The old rules of crypto investing just changed. Political risk is now price risk, and presidential business interests drive market movements. Here's how KillChain readers should adapt:

Immediate Actions:

Track the Trump Portfolio: Monitor all Trump family crypto interests: CRO, $TRUMP, $MELANIA, World Liberty Financial tokens. Presidential policy announcements now carry direct profit motive.

Political Calendar Integration: Fed meetings aren't the only dates that matter anymore. Truth Social earnings calls, Trump Media investor updates, and family crypto ventures all become market-moving events.

Regulatory Arbitrage: Tokens with Trump family connections likely receive favorable regulatory treatment. This creates systematic advantages that traditional technical analysis can't capture.

Strategic Positioning:

The CRO Trade: While ethically concerning, the math is compelling. Presidential backing creates a protective moat around CRO that doesn't exist for other altcoins. The venture will be called Trump Media Group CRO Strategy Inc. and will trade under the ticker MCGA. When this goes public, it becomes the most politically protected crypto play in history.

The Ethereum Hedge: Smart money recognizes that presidential crypto involvement increases systemic risk across the sector. Ethereum's institutional adoption provides diversification away from politically influenced tokens while maintaining crypto exposure.

The Political Rotation Strategy: As Trump family interests expand, expect rotational plays between their various crypto holdings. The key is positioning before announcements, not after.

The Bigger Picture: When Democracy Meets DeFi

This partnership represents more than financial innovation, it's a fundamental shift in the relationship between political power and digital assets. For the first time in American history, a sitting president has direct, quantifiable financial incentives tied to specific cryptocurrency price movements.

The precedent is set. Future presidents will face pressure to adopt similar strategies, creating permanent entanglement between political power and crypto markets. Your investment decisions now exist within a system where democratic institutions and digital asset prices move in lockstep.

For Crypto Investors:

Political risk is now price risk

Presidential announcements become trading catalysts

Regulatory capture creates systematic advantages

Constitutional conflicts generate investment opportunities

For American Democracy:

Financial markets gain direct influence over presidential decision-making

Foreign crypto exchanges obtain access to U.S. political influence

Democratic institutions become dependent on digital asset performance

Citizens' financial interests become subordinated to presidential profits

Bottom Line: The Game Just Changed

Whether you view this as brilliant financial strategy or democratic disaster, the market reality is clear: Presidential crypto involvement creates systematic advantages that didn't exist before August 26, 2025.

KillChain readers who positioned correctly on our Ethereum calls are sitting pretty. Now the next wave of crypto wealth will flow to those who understand political-crypto convergence before the mainstream catches on.

Trump just weaponized the presidency for crypto profits. The question isn't whether this is right or wrong, it's whether you're positioned to profit from the new rules or get crushed by them.

The Presidential Pump is real. Your portfolio strategy needs to account for it.

200+ AI Side Hustles to Start Right Now

AI isn't just changing business—it's creating entirely new income opportunities. The Hustle's guide features 200+ ways to make money with AI, from beginner-friendly gigs to advanced ventures. Each comes with realistic income projections and resource requirements. Join 1.5M professionals getting daily insights on emerging tech and business opportunities.

“Freedom has been defined as the opportunity for self-discipline.”

Because the real explosions are the scams you never saw coming.

Blast #1: FBI Warns "Particularly Vicious" Crypto Recovery Scam Re-Targets Victims

What Blew Up: The FBI's Internet Crime Complaint Center (IC3) issued an urgent alert about scammers impersonating law firms and government agencies to target crypto scam victims a second time. These "recovery firms" claim they can help victims recoup cryptocurrency losses, but instead drain additional funds from people already financially and emotionally devastated by previous fraud.

How They Wired the Charge:

Victim Database Exploitation: The scammers, often connected to the original fraud groups, maintain detailed records of previous victims including exact amounts lost, wire transfer dates, and third-party companies used in the initial scam. This insider knowledge creates false legitimacy when they contact victims months later claiming to offer "recovery services."

Authority Impersonation: The fraudsters pose as attorneys or representatives from legitimate agencies like the FBI, Consumer Financial Protection Bureau, or fabricated entities such as the "International Financial Trading Commission." They present fictitious but professional-looking documents and falsely claim to be "officially authorized partners" of the U.S. government.

Emotional Manipulation: The scheme specifically targets the elderly and emotionally vulnerable, exploiting victims' desperation to recover already-lost funds. Scammers use social media and messaging platforms to approach victims with offers that seem like governmental salvation after private devastation.

Fake Banking Infrastructure: Victims are told their lost funds are held in accounts at foreign banks and directed to register accounts on fraudulent banking platforms that appear legitimate but are designed to harvest additional personal and financial information.

Group Psychology Tactics: Scammers place victims into WhatsApp group chats with supposed "attorneys" and "bank representatives," creating an illusion of coordinated professional recovery efforts while maintaining supposed "secrecy and safety" to justify the unconventional communication channels.

Payment Extraction: The final phase demands upfront fees or "bank verification charges" paid via cryptocurrency or prepaid gift cards; payment methods that offer no recourse or traceability once transferred.

KillChain Blast Assessment

This represents the evolution of crypto fraud from single-strike theft to systematic victim re-harvesting. The "particularly vicious" designation stems from the psychological cruelty of targeting people who've already lost life savings, exploiting their desperation when they're most vulnerable.

The operational sophistication is remarkable: maintaining victim databases, creating fake government partnerships, and building fraudulent banking infrastructure demonstrates organized criminal enterprises, not opportunistic scammers. The fact that original scam groups often coordinate with "recovery" operations suggests a systematic pipeline designed to extract maximum value from each victim.

For the crypto ecosystem, this exposes a critical vulnerability in victim support infrastructure. Legitimate recovery is nearly impossible with cryptocurrency due to blockchain immutability, yet victims' hope creates exploitable desperation. The scammers weaponize victims' lack of technical understanding about crypto's irreversible nature.

The timing coordination between initial crypto scams and subsequent "recovery" outreach indicates sophisticated customer relationship management systems tracking victim financial and emotional states. This isn't random fraud, it's systematic re-victimization designed to extract remaining assets from people already financially devastated.

Your Blast Shield

The Golden Rule: If you suspect the site is a scam, it probably is. Trust your instincts! Legitimate recovery services don't need to convince you through high-pressure tactics.

Communication Channel Reality Check: No legitimate company, trader, or investor uses WhatsApp for professional services. No real recovery firm approaches victims through dating websites, "random" text messages, or social media DMs. Professional attorneys use official letterhead, verified email addresses, and documented phone systems.

Professional Structure Analysis: Legitimate law firms don't have "professors," "assistants," or "teachers" handling recovery cases. These titles are psychological manipulation designed to create authority while avoiding verifiable professional credentials.

Payment Method Verification: No legitimate recovery service forces you to pay "fees" or "taxes" to withdraw recovered funds. This is always a secondary extraction scam designed to drain remaining assets from already-victimized people.

The Harsh Mathematical Reality: Unfortunately, no "hacker" online can recover lost cryptocurrency. The blockchain's immutable nature means transactions cannot be reversed through technical means. Anyone claiming otherwise is exploiting your lack of technical knowledge.

Zero Trust Protocol: The FBI explicitly recommends a "zero trust" model for any unsolicited recovery offers. Assume no one should be trusted by default and every request must be independently verified through official channels.

Domain Investigation: Before engaging any recovery service, check domain age at whois.domaintools.com. Replace "google.com" with the scammer's website URL. Domains registered for only days, weeks, or months are strong scam indicators.

Recovery Scam Recognition: Watch for follow-up scams targeting previous crypto fraud victims. Scammers often DM victims offering fake "hacking services" or impersonating authorities. These advance-fee scams convince victims that their money can be recovered for upfront payments.

Immediate Action Protocol

Contact law enforcement immediately through official channels:

Internet Crime Complaint Center (IC3): File cyber scam complaints at ic3.gov

Local FBI Field Office: Report immediately at fbi.gov/contact-us/field-offices

Financial Crimes Enforcement Network (FinCEN): Report at fincen.gov/msb-state-selector

FTC Fraud Reporting: File complaints at reportfraud.ftc.gov

SEC Securities Violations: Report at sec.gov/tcr

CFTC Commodity Fraud: File at cftc.gov/complaint

Scammer Disruption: Report fraudulent websites to reduce their operational capacity:

Google Phishing Reports: Report phishing URLs directly to Google

Malware Reporting: Submit malicious software reports to Google

Domain Analysis: Use whois.domaintools.com to investigate scammer domain registration dates

AWS Hosted Scams: Use AWS abuse reporting forms for sites hosted on Amazon infrastructure

The Fraudfather’s Bottom Line

Crypto scam victims face a cruel mathematical reality: the same properties that make cryptocurrency attractive, irreversibility and decentralization, make recovery nearly impossible. Criminals exploit this desperation through fake recovery operations that re-victimize the same people. In crypto fraud, the first rule is harsh but true: once it's gone, it's gone. Anyone claiming otherwise is likely running the next scam.

KillChain Assessment: Bitcoin correction healthy but not complete. Ethereum supply shock mathematics are undeniable. Solana ETF approval represents next institutional onramp. Position accordingly.

Battlefield Intelligence: What the Numbers Truly Reveal.

The Tactical Read: Bitcoin is testing critical support after the $2.7 billion whale dump triggered a 13% slide from its August high of $124,290. Currently consolidating in the $108K-$113K range, BTC faces a make-or-break moment that will define Q4 momentum.

Technical Battleground:

Resistance: $113,600 (former support turned resistance)

Support: $108,000 (psychological level, institutional accumulation zone)

RSI: 42 (approaching oversold, but no reversal signals yet)

MACD: Bearish crossover confirmed, momentum still declining

Intelligence Brief: The math is unforgiving here. OG whales with sub-$10 cost basis are systematically distributing, requiring $110,000+ in fresh capital to absorb each BTC sold. Eric Trump's prediction of $175K by year-end looks optimistic given current supply dynamics.

However, institutional demand remains steady with ETFs seeing $178.9 million in inflows this week. Japan's potential Strategic Bitcoin Reserve debate adds geopolitical tailwinds that could override technical weakness.

KillChain Verdict: Hold above $108K or expect acceleration toward the $93K-$95K zone. A reclaim of $113.6K would signal the correction is complete and unlock $117K+ targets.

The Tactical Read: ETH just set a new all-time high at $4,953 before pulling back, but the supply shock mathematics are undeniable. Corporate treasuries have absorbed 2.6% of all ETH since June, while ETH ETFs absorbed 4.9% in the same period.

Technical Battleground:

Resistance: $5,000 (psychological barrier), $5,250 (next major target)

Support: $4,144 (critical level), $3,762 (major bounce zone)

RSI: 65 (strong momentum, room to run)

Pattern: Clean multi-year breakout, no overhead resistance

Intelligence Brief: This isn't just another alt pump. Two publicly traded companies, Sharplink and Bitmine, both own more than $1 billion in ETH, and BitMine has set an explicit goal of accumulating 5% of the token's overall supply.

The institutional preference is clear: Stablecoins account for 40% of all blockchain fees and more than half are powered by the Ethereum blockchain. Wall Street chose Ethereum for infrastructure, not speculation.

With approximately 121 million ETH in circulation and EIP-1559 burning tokens during network usage, we're watching real-time supply destruction meet systematic institutional accumulation.

KillChain Verdict: $5K is inevitable. The only question is timeframe. Standard Chartered maintains $7,500 year-end target, and the math supports it. Current consolidation above $4,300 is healthy before next leg.

The Tactical Read: SOL gained 18% in the past week and 15.54% over the month, showing institutional-grade momentum. Bloomberg Intelligence analysts now give 95% chance of Solana ETF approval by end of 2025, shifting from speculation to structural demand.

Technical Battleground:

Resistance: $222.66 (major breakout level), $230.32 (next target)

Support: $204.42 (immediate), $180 (major bounce zone)

RSI: 58.83 (neutral, room for expansion)

All-Time High: $294.85 (January 2025) - still 28% upside to retest

Intelligence Brief: Solana's ecosystem metrics are screaming bullish. Solana confidence reached a three-month high with institutions significantly investing in SOL. The DePIN narrative, memecoin infrastructure, and fastest transaction speeds create multiple value accrual mechanisms.

Unlike other L1s struggling with "blockchain trilemma," Solana solved scalability without sacrificing decentralization. The network processes transactions at lightning speed with low fees while maintaining security.

KillChain Verdict: ETF approval catalyst could trigger 40%+ move toward ATH retest. Break above $222.66 confirms next leg to $258+ range. This is early institutional positioning before retail FOMO.

Market Structure Analysis

Cross-Asset Intelligence: The great rotation from BTC to ETH accelerated this week. Whales converted $2+ billion from Bitcoin into Ethereum, with 275.5K ETH ($1.3 billion) immediately staked. This isn't profit-taking, it's strategic reallocation.

Liquidation Dynamics: Over $930 million in liquidations hit leveraged traders, with long Bitcoin positions suffering the heaviest losses. The leverage flush creates healthier market structure for the next move higher.

Regulatory Positioning: With multiple ETF approvals likely and stablecoin regulation clarifying, institutional infrastructure is finally catching up to crypto innovation. The next wave of adoption won't be retail-driven, it will be systematic capital allocation.

⚠️ The KillChain Disclaimer ⚠️

Informational & Educational Use Only

All content in this newsletter, including but not limited to market commentary, tactical read-outs, “buy-zone” language, and any linked training materials, is provided strictly for general, educational, and informational purposes. Nothing herein constitutes (or should be interpreted as) personalized investment, legal, accounting, or tax advice.

No Investment Recommendations

References to “accumulate,” “scale in,” “trim,” or similar calls to action are illustrative frameworks, not specific recommendations to buy, sell, or hold any digital asset, security, or derivative. You alone are responsible for evaluating the merits and risks associated with any use of the information provided before making any investment or trading decision. Consult a registered investment adviser or other qualified professional regarding your individual circumstances.

About the FraudFather:

The Fraudfather didn’t learn fraud from influencers or movies. He learned it chasing terrorists, flipping money launderers, and dismantling multi-million-dollar schemes, before most people knew what “DeFi” meant.

A former Senior Special Agent and Supervisory Intelligence Operations Officer, he spent over two decades tracking financial predators across borders, blockchains, and bureaucracies. From dark web forums to government war rooms, he’s seen every lie and loophole up close.

Now a “recovering” digital identity and cybersecurity executive, he’s turned his sights to teaching crypto, where old scams wear new skins, and smart contracts get played like slot machines.

Through The Fraudfather persona, he’s exposing how fraud really works on-chain:

How social engineers bypass wallet security

How cross-chain laundering pipelines stay hidden

How scammers weaponize human psychology faster than regulators can blink

This isn’t theory.

It’s operational intelligence, on-chain and in near real time.

Follow the Fraudfather and stay five moves ahead of the next exploit