Banks that spent years lobbying against crypto are now discovering that stablecoins create an immutable paper trail that makes their own compliance departments look primitive by comparison.

The Plot Twist That Will Flip Crypto Regulation on Its Head

How Stablecoins Became Law Enforcement's Secret Weapon Against Traditional Banks

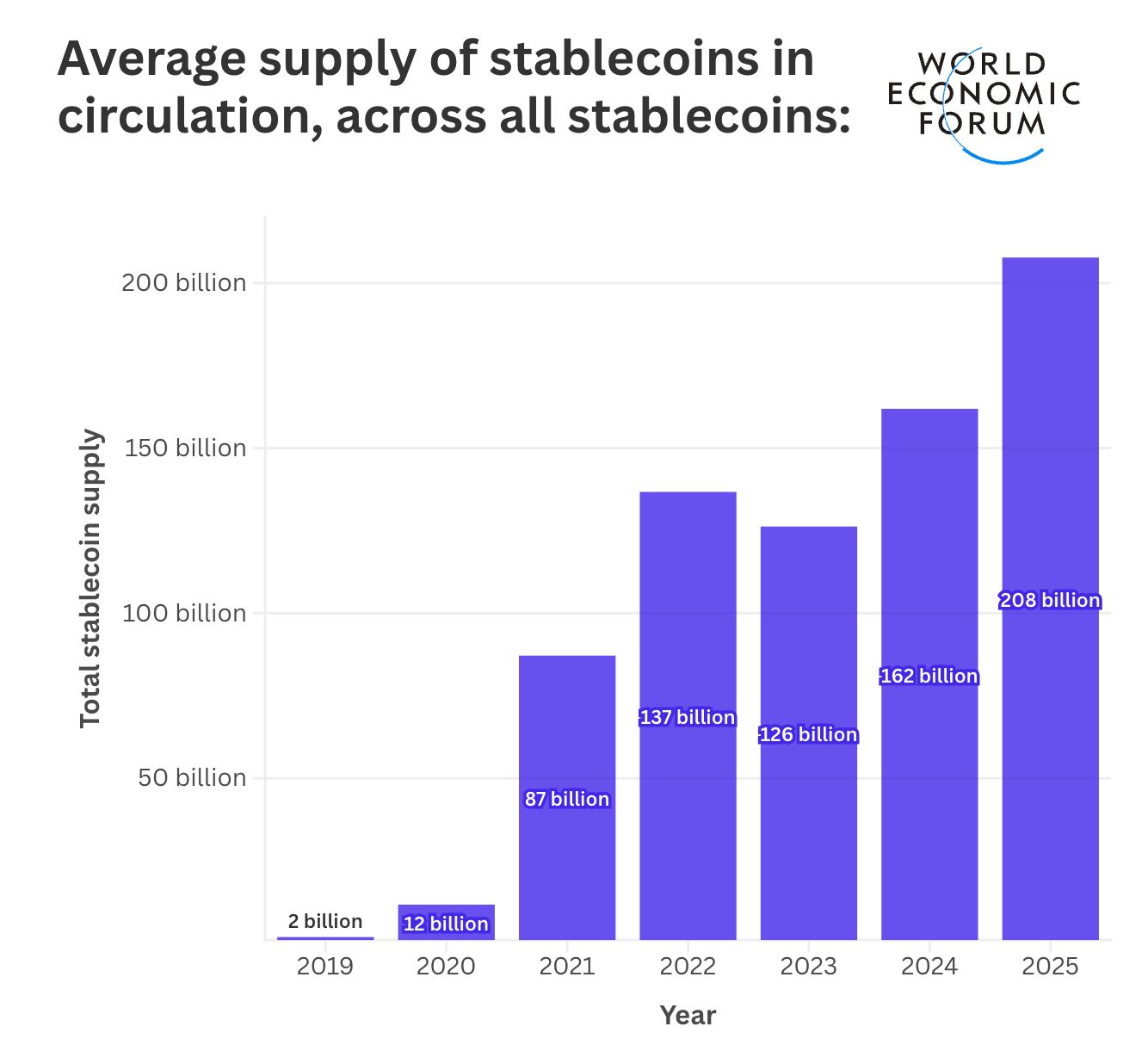

The Fraudfather Intel: While politicians and regulators spent years demonizing crypto as a money laundering paradise, something extraordinary happened. The $200+ billion stablecoin ecosystem quietly became the most transparent financial surveillance system ever created. Now, law enforcement agencies are discovering they can track criminal money flows through crypto faster and more accurately than through traditional banks. The hunters have become the hunted, and the implications are about to reshape everything.

The Great Reversal: When Crypto Becomes the Cop

Here's the plot twist nobody saw coming: The same blockchain technology that regulators claimed would enable financial crime is now exposing it at unprecedented scale.

While traditional banks hide behind privacy laws and jurisdictional red tape, every stablecoin transaction is permanently recorded on public blockchains that law enforcement can analyze in real-time. No subpoenas required. No international treaties needed. No bank executives claiming they "didn't know" about suspicious activity.

The irony is delicious: Banks that spent years lobbying against crypto are now discovering that stablecoins create an immutable paper trail that makes their own compliance departments look primitive by comparison.

The $200 Billion Surveillance Network Nobody Asked For

The Numbers Tell the Story:

$200+ billion in stablecoin circulation globally

Every transaction permanently recorded and publicly viewable

Real-time tracking across jurisdictions without legal barriers

No privacy walls that traditional banks hide behind

What This Actually Means: Law enforcement now has access to a financial surveillance system that would make the Patriot Act look like a suggestion box. Every dollar-equivalent flowing through the stablecoin ecosystem is traceable, trackable, and permanently archived.

Traditional banks file Suspicious Activity Reports based on incomplete information from their own walled gardens. Stablecoins provide the complete picture in real-time, across all participants, forever.

How Traditional Finance Became the Real Money Laundering Haven

The Dirty Secret: While regulators obsessed over crypto, traditional banking remained the real money laundering infrastructure of choice for serious criminals.

Why Banks Are the Perfect Crime Partners:

Walled Gardens: Each bank only sees its own slice of criminal activity

Jurisdictional Games: International transfers disappear into legal black holes

Privacy Protection: Bank secrecy laws protect criminals more than depositors

Plausible Deniability: "We had no way of knowing" is a viable legal defense

The Reality Check: A drug cartel moving $10 million through traditional banks might touch 15 different institutions across 8 countries. Each bank files reports based on incomplete data. Law enforcement spends months or years stitching together the full picture through legal channels.

The same $10 million moved through stablecoins? Every transaction is visible to anyone with an internet connection within seconds.

The Russian Ruble Smoking Gun

Case Study in Real-Time: Recent sanctions evasion cases have exposed exactly how this plays out in practice.

Russian entities facing sanctions discovered they could launder money by bouncing between traditional banking and stablecoin rails. But here's the kicker: the stablecoin portions were immediately traceable while the traditional banking segments remained opaque.

Law enforcement agencies found themselves in the bizarre position of using blockchain analysis to expose criminal activity that traditional banks had missed or ignored.

The Pattern: Criminals are learning that traditional finance is actually safer for money laundering than crypto, because banks provide privacy protection that blockchains simply cannot.

The Compliance Revolution Nobody Saw Coming

Traditional Bank Compliance:

Partial view of customer activity

Reactive reporting after suspicious patterns emerge

Limited cross-institutional visibility

Months or years to trace complex transactions

Heavy reliance on bank cooperation and legal processes

Stablecoin Compliance:

Complete transaction history from genesis block

Real-time pattern analysis across all participants

Global visibility without jurisdictional barriers

Instant tracing of complex multi-hop transactions

No cooperation required - everything is public

The Game Changer: Compliance professionals at traditional banks are starting to realize they're working with Stone Age tools compared to blockchain analytics.

Why This Changes Everything

For Regulators: The entire narrative flips. Instead of crypto being the problem to solve, stablecoins become the solution for financial crime detection. Regulators who spent years trying to kill crypto might find themselves mandating its use for transparency.

For Traditional Banks: The competitive advantage of privacy is becoming a liability. When law enforcement can track criminal activity through crypto but not through banks, guess who gets blamed for enabling crime?

For Crypto: The industry shifts from defending against money laundering accusations to leading the fight against financial crime. Stablecoins become the enforcement tool, not the enforcement target.

The Intelligence Revolution in Real-Time

Live Blockchain Data as Criminal Intelligence:

Today's sophisticated criminal organizations don't operate purely in crypto or purely in traditional finance. They mix both systems, thinking they're covering their tracks.

The Reality: Every time criminal proceeds touch a stablecoin, they create an permanent, public record that can expose their entire operation. Even if 90% of their money flows through traditional banks, that 10% stablecoin exposure can unravel the whole scheme.

The Network Effect: As stablecoin adoption grows, criminal organizations face an impossible choice:

Avoid stablecoins entirely and lose access to the fastest, cheapest global payment rails

Use stablecoins and risk exposing their entire operation through blockchain analysis

The Power Shift Nobody Talks About

The Old World: Banks controlled financial information and doled out access to law enforcement through legal processes that could take months or years.

The New World: Anyone with blockchain analytics tools can track suspicious financial activity in real-time, without asking permission from banks or navigating international legal frameworks.

The Implication: Financial surveillance is becoming democratized. Government agencies, private investigators, journalists, and compliance firms now have access to financial tracking capabilities that were previously exclusive to major intelligence agencies.

What Happens Next

Phase 1: Law enforcement agencies quietly discover stablecoin analysis is more effective than traditional financial investigation for many crimes.

Phase 2: Regulators realize their anti-crypto stance was preventing them from accessing the most powerful financial crime detection tools ever created.

Phase 3: Traditional banks face pressure to integrate with stablecoin infrastructure or risk being left out of the new transparent financial system.

Phase 4: "Privacy" in finance becomes redefined as protection for citizens, not protection for criminals.

The Bottom Line: Follow the Money, Literally

The Ultimate Irony: The crypto industry that regulators tried to destroy for being "too anonymous" has created the most transparent financial system in human history.

The Power Reversal: Banks that spent years attacking crypto for enabling crime are discovering that they're the ones providing criminals with privacy protection.

The New Reality: In a world where every stablecoin transaction is permanently recorded and publicly auditable, traditional banking's privacy walls start looking less like customer protection and more like criminal enablement.

The Question: If you were running a criminal organization moving hundreds of millions in illicit funds, would you choose the system where every transaction is permanently recorded on a public blockchain, or the system where banks promise to keep your activity private behind legal walls?

The Answer: Criminals already know. Now law enforcement is catching up.

The Endgame

The stablecoin surveillance state isn't coming. It's already here.

Every major criminal organization will soon face a choice: operate in the shadows of traditional finance, or accept permanent transparency in the stablecoin economy.

Law enforcement agencies are about to discover they have a global, real-time financial tracking system that makes every previous surveillance technology look like smoke signals.

And the crypto industry that spent years defending itself against money laundering accusations?

They're about to become the global financial crime fighting force.

The hunters have become the hunted. The regulators are about to become the regulated. And the transparent financial system nobody asked for is about to make privacy-focused traditional banking look like a criminal conspiracy.

Welcome to the plot twist that changes everything.

When the surveillance state meets the blockchain state, everybody gets watched. The question is: who's doing the watching?

Got a Second? The KillChain reaches 4,500+ readers every week including security professionals, executives, and anyone serious about understanding and utilizing crypto. Know someone who needs this intelligence? Forward this newsletter, I appreciate it!

Business news doesn’t have to be boring

Morning Brew makes business news way more enjoyable—and way easier to understand. The free newsletter breaks down the latest in business, tech, and finance with smart insights, bold takes, and a tone that actually makes you want to keep reading.

No jargon, no drawn-out analysis, no snooze-fests. Just the stuff you need to know, delivered with a little personality.

Over 4 million people start their day with Morning Brew, and once you try it, you’ll see why.

Plus, it takes just 15 seconds to subscribe—so why not give it a shot?

The KillChain Assessment

Post-Fed Reality Check

The Fed Delivered: 25bp cut to 4%-4.25% on September 17, exactly as predicted. But here's the plot twist… new Fed member Stephen Miran dissented for a BIGGER cut. When the newest guy on the block is calling for 50bp while the establishment delivers 25bp, that's not dovish enough for this macro environment.

Key Performance Against Previous KillChain Baseline:

Bitcoin: $115,671 vs $116,286 previous = -0.5% (post-Fed consolidation)

Ethereum: $4,467 vs $4,705 previous = -5.1% (deeper pullback setting up)

Solana: $238.82 vs $243.39 previous = -1.9% (relative strength holding)

Bottom Line: Post-Fed reality check in progress. Bitcoin holding above $115K validation level with -0.5% pullback. Ethereum building massive compression at -5.1% for explosive $5K move. Solana showing relative strength at -1.9% while ETH bleeds harder. This is healthy consolidation after macro events; smart money accumulating before the next leg higher.

The Fed Pivot Reality

The Federal Reserve cut its benchmark fed funds rate range by 25 basis points to 4%-4.25%, its first reduction since December. But the real signal came from Stephen Miran's dissent for a larger cut. When the newest Fed member is the most dovish, policy is behind the curve.

What This Means: The 25bp cut wasn't the end, it was the beginning. The dot plot signals more cuts ahead, and crypto just got its first taste of the new regime.

Your Position: You're holding through healthy post-Fed consolidation. Bitcoin at $115,671 proving Fed policy works above $115K validation. Ethereum at $4,467 building the compression for explosive $5K assault. Solana at $238.82 showing relative strength leadership. This isn't breakdown; it's smart money accumulation before the next explosive leg higher.

The Fed delivered. Now we digest and reload for the real rally.

Battlefield Intelligence: What the Numbers Truly Reveal.

KillChain Verdict: $115,671 is exactly where you want BTC post-Fed. We got the cut, spiked, consolidated, and held above validation levels.

Bitcoin: Post-Fed Reality Check

Current: $115,671 (-0.5% since last newsletter) Status: Healthy post-Fed consolidation above $115K support

The Tactical Read:

BTC at $115,671, giving back the initial Fed rally gains and settling into post-policy consolidation mode. The -0.5% pullback from our $116,286 call represents exactly what you want to see after a major macro event: initial excitement followed by rational price discovery. Bitcoin held above the critical $115K Fed validation level, proving the 25bp cut provided the foundation for higher prices.

Technical Battleground:

Current: $115,671 (healthy post-Fed consolidation)

Key Support: $115,000 (Fed validation level), $113,500 (deeper support)

Immediate Resistance: $116,500-$118,000 (retest targets)

RSI: 55 (reset from Fed spike, room to run higher)

Intelligence Brief:

Bitcoin's -0.5% pullback after the initial Fed rally is textbook macro trading. The market got its 25bp cut, spiked, then settled as reality set in. But here's what matters: we're holding above $115K, which validates the Fed policy shift as bullish for crypto. Stephen Miran's dissent for larger cuts signals more dovish policy ahead.

KillChain Verdict: $115,671 is exactly where you want BTC post-Fed. We got the cut, spiked, consolidated, and held above validation levels. This isn't weakness, but a healthy digestion before the next leg toward $118K-$120K as more cuts get priced in.

KillChain Verdict: $4,467 represents the final compression before Ethereum's explosive assault on $5,000.

Ethereum: The Great Compression

Current: $4,467 (-5.1% since last newsletter)

Status: Deeper pullback building explosive energy for $5K assault

The Tactical Read:

ETH at $4,467, giving back more ground with a -5.1% pullback from our $4,705 call, but this is classic Ethereum behavior before explosive moves. While Bitcoin consolidates post-Fed, Ethereum is building the compression that historically precedes its most violent rallies. The fundamentals remain unstoppable: stablecoins on Ethereum mainnet and Layer 2s have surpassed $171 billion circulation, up 78% year-over-year.

Technical Battleground:

Current: $4,467 (deeper compression, loaded spring)

Key Support: $4,400-$4,350 (critical defense zone)

Immediate Resistance: $4,600-$4,700 (retest zone), $5,000 (ultimate target)

RSI: 42 (oversold setup, explosive potential)

Intelligence Brief:

The -5.1% pullback is NOT weakness, but rather smart money accumulation before Ethereum's trademark vertical move. Arbitrum ($8.8B) and Base ($3.9B) stablecoin circulation proves the infrastructure is exploding regardless of price action. This is economic foundation building, not speculation.

KillChain Verdict: $4,467 represents the final compression before Ethereum's explosive assault on $5,000. When ETH moves, it moves VIOLENTLY. This -5.1% pullback is creating the energy for a $500+ surge when momentum returns. The deeper the compression, the more explosive the release.

KillChain Verdict: $238.82 with only -1.9% weakness while ETH drops -5.1%? This is textbook relative strength during market pullbacks.

Solana: Relative Strength in a Down Market

Current: $238.82 (-1.9% since last newsletter) Status: Outperforming in the pullback, institutional accumulation evident

The Tactical Read:

SOL at $238.82, down -1.9% from our $243.39 call but showing impressive relative strength versus Bitcoin (-0.5%) and especially Ethereum (-5.1%). When the market pulls back and SOL only gives up -1.9% while ETH bleeds -5.1%, that's the signature of institutional accumulation. Companies like Bit Mining, Upexi, and DeFi Development Corp together hold over 3.5 million SOL worth $835+ million at current prices.

Technical Battleground:

Current: $238.82 (relative strength leader in pullback)

Key Support: $231 (major defense), $220 (deeper cushion)

Immediate Resistance: $245-$252 (retest zone), $300 (explosive target)

RSI: 47 (oversold but resilient, loaded for next move)

Intelligence Brief:

Solana's 100,000 TPS mainnet capability and $10.7 billion DeFi ecosystem growth explains the relative strength. The Alpenglow upgrade (late 2025) will finalize blocks in 150 milliseconds, positioning SOL as the only blockchain capable of true real-time settlement. Smart money is accumulating ahead of these infrastructure upgrades.

KillChain Verdict: $238.82 with only -1.9% weakness while ETH drops -5.1%? This is textbook relative strength during market pullbacks. SOL is the institutional favorite, positioned to explode higher when risk appetite returns. Target: $300 when the next wave hits.

⚠️ The KillChain Disclaimer ⚠️

Informational & Educational Use Only

All content in this newsletter, including but not limited to market commentary, tactical read-outs, “buy-zone” language, and any linked training materials, is provided strictly for general, educational, and informational purposes. Nothing herein constitutes (or should be interpreted as) personalized investment, legal, accounting, or tax advice.

No Investment Recommendations

References to “accumulate,” “scale in,” “trim,” or similar calls to action are illustrative frameworks, not specific recommendations to buy, sell, or hold any digital asset, security, or derivative. You alone are responsible for evaluating the merits and risks associated with any use of the information provided before making any investment or trading decision. Consult a registered investment adviser or other qualified professional regarding your individual circumstances.

On September 8, 2025, attackers compromised some of the most popular JavaScript packages on earth; packages downloaded billions of times per week. Their target? Your crypto wallets.

The NPM Attack That Could Have Drained Your Wallet

How Billions of Downloads Became a Crypto Heist Vector

TL;DR: On September 8, 2025, attackers compromised some of the most popular JavaScript packages on earth; packages downloaded billions of times per week. Their target? Your crypto wallets. The malware silently swapped wallet addresses mid-transaction, routing your funds to attacker-controlled wallets that looked nearly identical to the real ones. This wasn't random malware. This was surgical precision targeting the crypto ecosystem.

Important: Multiple September 2025 Attacks

This article covers the September 8, 2025 crypto wallet hijacking attack that targeted packages like chalk and debug. There was a separate but related attack called "Shai-Hulud" on September 15 that focused on credential theft and self-replication across GitHub accounts.

Key Differences:

September 8 Attack: Crypto wallet address swapping (covered in this article)

September 15 "Shai-Hulud": Credential theft and automatic spreading to other packages

Both attacks are serious, but this article focuses on the crypto-specific threat to your wallets.

What Actually Happened

Imagine if someone could swap the numbers on your bank deposit slip after you filled it out but before you handed it to the teller. That's essentially what happened here, except instead of a bank slip, it was your crypto transactions.

The Attack Chain:

The Infiltration: Attackers compromised dozens of NPM packages that are basically the building blocks of the modern internet

The Spread: These packages are used by crypto wallets, DeFi apps, exchanges—everything you interact with daily

The Heist: Malicious code quietly monitored for crypto wallet addresses and swapped them with lookalike addresses controlled by the attackers

The Execution: Victims saw transactions that looked normal but sent funds to attacker wallets instead

No pop-ups. No phishing sites. No warning signs. Just silent theft.

The Packages That Betrayed You

These aren't obscure libraries buried in some developer's basement. These are the foundation of the modern web:

Core Infrastructure:

chalk- Makes terminal text colorful (used everywhere)debug- Helps developers find bugsansi-styles- Text formatting for developers

The Scary Part: Even if you never heard of these packages, your favorite crypto app probably uses them. Through something called "transitive dependencies," compromising one popular package can infect thousands of applications that rely on it.

Think of it like contaminating the water supply instead of poisoning individual drinks.

How the Heist Actually Worked

This wasn't amateur hour. The attackers built a crypto-specific weapon:

Step 1: Monitor Everything

The malware sat quietly in your browser, watching network traffic for crypto wallet addresses.

Step 2: Address Swapping

When it detected a wallet address (like 0x1234...abcd), it instantly replaced it with a nearly identical attacker address (like 0x1235...abcd).

Step 3: Silent Execution

You'd see the transaction, think everything looked normal, sign it, and send your crypto straight to the attacker.

The Genius: The attacker still needed YOU to sign the transaction. They didn't steal your private keys, but rather tricked you into sending funds voluntarily.

Why This Attack Was So Effective

Trust in Open Source: The crypto ecosystem runs on open-source code that anyone can modify. Usually that's a strength. Here, it became the vulnerability.

Dependency Hell: Modern apps use thousands of code packages. Nobody has time to audit every single one.

Address Similarity: Wallet addresses are long strings of random characters. Swapping 0x1234...abcd for 0x1235...abcd is nearly undetectable to the human eye.

No Technical Skills Required: The victim didn't need to download anything or visit a phishing site. Just using compromised apps was enough.

The Addresses You Need to Blacklist

Security researchers have identified some of the attacker-controlled wallets. If you see these addresses anywhere, DO NOT SEND FUNDS:

GitHub Security Analysis:

Palo Alto Networks Analysis - Technical breakdown of the September 8 crypto attack

Vercel Security Response - Industry response and mitigation

Sonatype Incident Tracking - Ongoing monitoring and IOCs

Compromised Packages List: The September 8 attack specifically targeted these 18 packages with billions of weekly downloads:

chalk, debug, ansi-styles, supports-color, chalk-template

strip-ansi, color-convert, color-name, color-string

has-ansi, wrap-ansi, slice-ansi, simple-swizzle, is-arrayish

error-ex, backslash, supports-hyperlinks

Warning Signs to Check:

Unexpected crypto transaction destinations

Wallet addresses that look similar but aren't exact matches

Any transactions you didn't explicitly initiate

How to Protect Yourself Right Now

For Regular Crypto Users:

1. Double-Check Every Address Before sending any transaction, manually verify the destination address character by character. Yes, it's annoying. No, your funds aren't worth the time savings.

2. Use Wallets with Transaction Simulation Wallets that show you exactly what a transaction will do BEFORE you sign it can catch these attacks. Look for wallets that partner with security providers like Blockaid.

3. Start Small, Then Scale When interacting with any new dApp or protocol, send a tiny test transaction first. If that works correctly, then send the larger amount.

4. Keep Your Wallet Software Updated Wallet providers are constantly updating security features. Turn on auto-updates or check for updates weekly.

For Developers and Project Teams:

1. Audit Your Dependencies Immediately Run npm audit, pnpm why, or yarn list to see if any compromised packages are in your stack. Check both direct dependencies and transitive ones.

2. Implement Transaction Simulation Every transaction should be simulated and validated before reaching users. If you're not doing this, you're essentially trusting that nothing in your stack is compromised.

3. Consider Dependency Pinning Instead of accepting automatic updates to packages, manually review and approve each update. Yes, it's more work. No, it's not optional anymore.

4. Add Address Validation Build address validation into your UX. Show users the full address, highlight any recent changes, and require explicit confirmation for large transactions.

The Bigger Picture: Software Supply Chain Wars

This attack represents a fundamental shift in how crypto gets targeted:

Old School: Phish users directly with fake websites New School: Compromise the infrastructure that crypto applications rely on

Why This Matters: Every piece of code your favorite crypto app uses becomes part of the attack surface. A vulnerability in a text-formatting library can drain your wallet.

The Problem Scale: The NPM ecosystem has over 2 million packages. Manually auditing all of them is impossible. Yet any one of them could be weaponized against crypto users.

What the Industry Needs to Do

For Wallet Providers:

Implement mandatory transaction simulation

Partner with security providers for real-time threat detection

Build better UX for address verification

For DeFi Protocols:

Audit your entire dependency tree, not just your smart contracts

Implement client-side security scanning

Consider using immutable frontends or decentralized hosting

For Infrastructure Providers:

Better package signing and verification for NPM

Real-time monitoring for malicious code injection

Automated security scanning for transitive dependencies

The Hard Truth About Crypto Security

Your private key isn't the only thing that can be compromised. The apps you use to manage that private key can be weaponized against you.

Decentralization doesn't automatically mean security. Decentralized apps still rely on centralized infrastructure like NPM packages.

Trust, but verify isn't just good advice—it's survival in an ecosystem where a text-formatting library can drain your portfolio.

The Fraudfather Bottom Line

The September 2025 NPM attack was a wake-up call: the crypto ecosystem's reliance on traditional software infrastructure creates massive attack surfaces that most users never consider.

The solution isn't to stop using crypto. It's to demand better security practices from every layer of the stack and to adopt defensive practices as users.

Remember: In crypto, you are your own bank. That means you're also your own security team. Act accordingly.

About the FraudFather:

The Fraudfather didn’t learn fraud from influencers or movies. He learned it chasing terrorists, flipping money launderers, and dismantling multi-million-dollar schemes, before most people knew what “DeFi” meant.

A former Senior Special Agent and Supervisory Intelligence Operations Officer, he spent over two decades tracking financial predators across borders, blockchains, and bureaucracies. From dark web forums to government war rooms, he’s seen every lie and loophole up close.

Now a “recovering” digital identity and cybersecurity executive, he’s turned his sights to teaching crypto, where old scams wear new skins, and smart contracts get played like slot machines.

Through The Fraudfather persona, he’s exposing how fraud really works on-chain:

How social engineers bypass wallet security

How cross-chain laundering pipelines stay hidden

How scammers weaponize human psychology faster than regulators can blink

This isn’t theory.

It’s operational intelligence, on-chain and in near real time.

Follow the Fraudfather and stay five moves ahead of the next exploit