The four-year crypto cycle is dead. And ETFs killed it.

Crash Expert: “This Looks Like 1929” → 70,000 Hedging Here

Mark Spitznagel, who made $1B in a single day during the 2015 flash crash, warns markets are mimicking 1929. Yeah, just another oracle spouting gloom and doom, right?

Vanguard and Goldman Sachs forecast just 5% and 3% annual S&P returns respectively for the next decade (2024-2034).

Bonds? Not much better.

Enough warning signals—what’s something investors can actually do to diversify this week?

Almost no one knows this, but postwar and contemporary art appreciated 11.2% annually with near-zero correlation to equities from 1995–2024, according to Masterworks Data.

And sure… billionaires like Bezos and Gates can make headlines at auction, but what about the rest of us?

Masterworks makes it possible to invest in legendary artworks by Banksy, Basquiat, Picasso, and more – without spending millions.

23 exits. Net annualized returns like 17.6%, 17.8%, and 21.5%. $1.2 billion invested.

Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

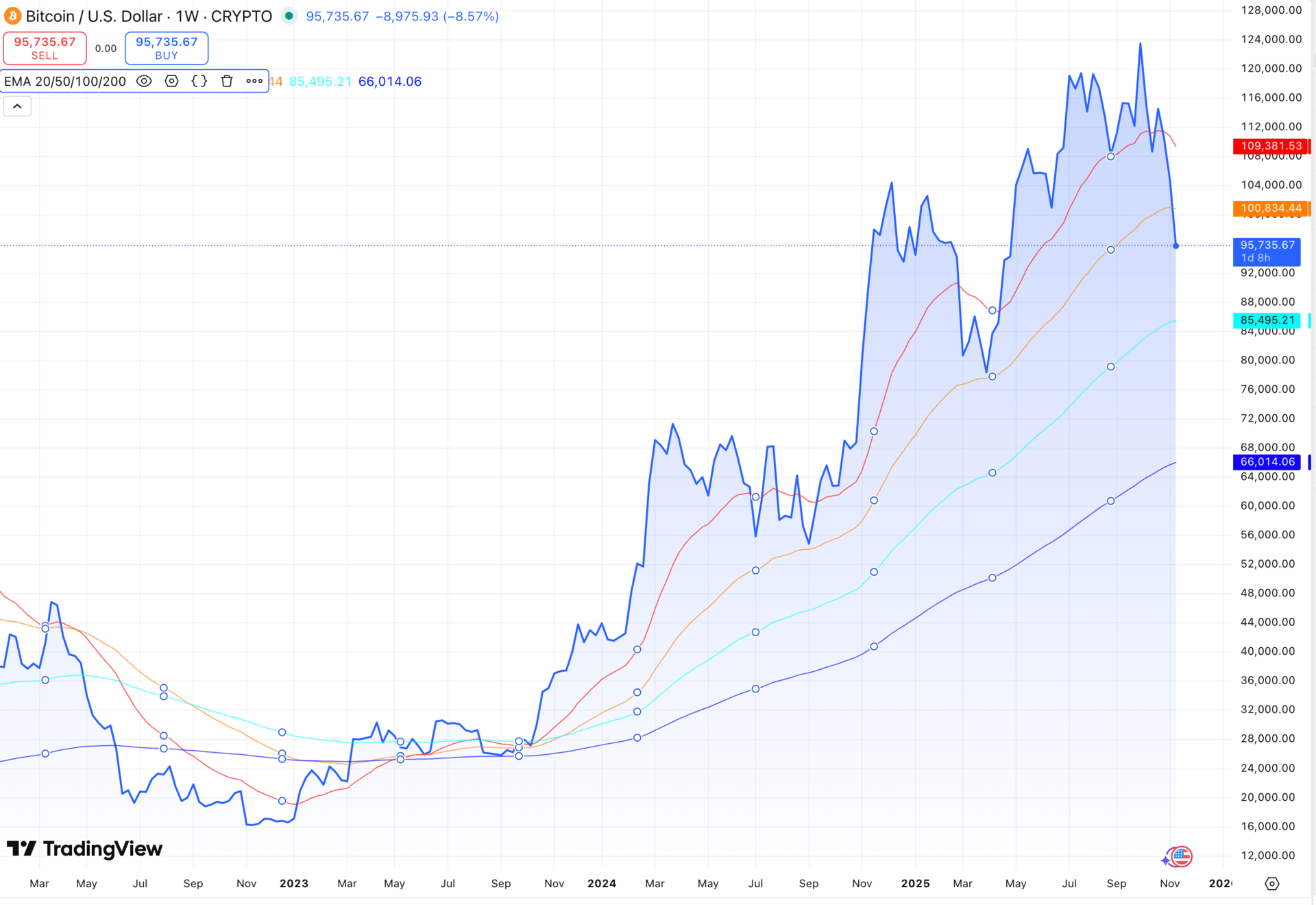

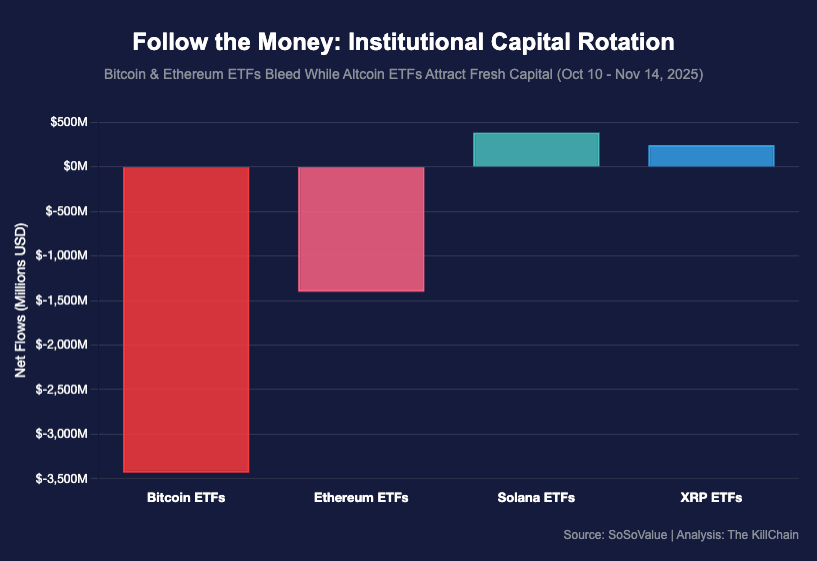

Bitcoin fell to $94,147, its lowest level in six months. ETFs bled $870 million in a single day, the second-largest outflow ever. Long-term holders dumped 815,000 BTC worth $79 billion. The Fear & Greed Index crashed to 22. Retail is panicking. But here's what nobody's telling you: the four-year crypto cycle just died, and a new pattern emerged in its place. Since 2023, Bitcoin has followed a mechanical six-month rotation cycle driven by institutional ETF flows, not retail emotion. While Bitcoin and Ethereum ETFs hemorrhaged $4.8 billion, Solana and XRP ETFs attracted $625 million during the same bloodbath. This isn't market collapse. This is coordinated wealth extraction. Wall Street weaponized ETFs to kill the predictable halving cycle and replace it with quarterly performance windows designed to shake out retail at exact support levels. This week: how the 50-week EMA became the new institutional accumulation trigger, why Harvard tripled its Bitcoin position during the crash, and what the death of the four-year cycle means for everyone still waiting for the bottom that already happened.

The ETF Weapon: How Wall Street Killed the Four-Year Cycle and Nobody Noticed

I've spent two decades following money. Chasing bad guys through hawala networks and P2P schemes. Flipping money launderers who thought they were smarter than the system. Dismantling multi-million-dollar fraud schemes before "DeFi" was even a word. You develop a sense for patterns. You learn to recognize when the game has changed, even when everyone else is still playing by the old rules.

The four-year crypto cycle is dead. And ETFs killed it.

That's not hyperbole. That's pattern recognition. For almost a decade, Bitcoin followed a rhythm so predictable you could set your watch to it: halving, accumulation, parabolic rally, peak 18 months later, then a soul-crushing bear market. The 2016 halving was in July; cycle top December 2017, exactly 18 months. The 2020 halving was in May; cycle topped November 2021, exactly 18 months. The entire industry built itself around this four-year heartbeat.

The 2024 halving was in April. Eighteen months from then brings us to right now, November 2025. Bitcoin should be collapsing. Instead, it's consolidating above $96,000 after briefly touching six-month lows. After the 2017 top, Bitcoin lost 40% within a week. After the 2021 top, same thing: 40% gone in three weeks. This time? We're six weeks past the October 6th high of $126,000 and down only 24%. The price action doesn't match the pattern. The pattern is broken.

But here's what almost nobody is talking about: the pattern didn't just break randomly. It was systematically dismantled by a new market structure that fundamentally changed how Bitcoin moves. That structure is ETFs. And if you're not paying attention to how institutions are weaponizing these products, you're about to get played again.

The Pattern You're Not Seeing

Let me show you something that should terrify retail traders. Since Bitcoin spot ETFs launched in January 2024, a new pattern has emerged. It's happened three times now with mechanical precision:

First, Bitcoin bottoms on the 50-week exponential moving average. Then it rallies hard for approximately six months. Then it crashes right back down to test the EMA as support. Rinse, repeat. Three times since 2023. Not four years. Six months.

First, Bitcoin bottoms on the 50-week exponential moving average. Then it rallies hard for approximately six months. Then it crashes right back down to test the EMA as support. Rinse, repeat. Three times since 2023. Not four years. Six months.

The old cycle was retail-driven and emotional: pure boom and bust, manic euphoria followed by capitulation. This new cycle is institutionally driven, calculated, and methodically profitable. Institutions don't operate on four-year timeframes. They operate on quarterly earnings, fund performance reviews, and bonus structures. Six months is a long time in institutional trading. It's two quarters. It's one performance period. It's exactly long enough to build a position, run it up, distribute to euphoric retail, and reload.

Look at the mechanics of how this plays out. Over the past month, long-term Bitcoin holders have sold 815,000 BTC, roughly $79 billion worth. Their share of total supply dropped from 76% to 70% in 30 days. That's the largest distribution wave since the 2021 peak. These are OG wallets that bought at $15K to $40K now booking six-figure gains. Smart money taking profits.

At the exact same time, Bitcoin ETFs hemorrhaged $870 million on Thursday, the second-largest single-day outflow in history. Since October 10th, Bitcoin ETFs have recorded $3.43 billion in net outflows across 16 of the last 25 trading days. Grayscale's Bitcoin Mini Trust alone bled $318.2 million in one session. BlackRock's IBIT, which had been the steady institutional buyer all year, posted its largest-ever outflow: $463 million in a single day.

Retail watches this happen and panics. "BlackRock is dumping!" "The institutions are leaving!" "The bull run is over!" Twitter melts down. Reddit fills with loss porn. The Fear & Greed Index crashes to 22, levels not seen since March. Over $1.1 billion in leveraged long positions get liquidated in 24 hours as stop losses cascade.

Then something interesting happens. The outflows stop. New inflows appear. Bitcoin stabilizes. The rally resumes. And institutions are sitting on fresh positions bought 15% to 20% cheaper than where they sold.

This isn't conspiracy theory speculation. This is observable market behavior with billions of dollars in documented flows. The pattern is so consistent it's almost boring. Big inflows, six-month rally, massive outflows paired with coordinated fear, retail capitulation, institutional re-accumulation, repeat.

The Divergence That Tells the Real Story

Here's where it gets really interesting. While Bitcoin and Ethereum ETFs were bleeding billions last week, something else was happening. Solana ETFs printed their 14th consecutive day of inflows. Thursday alone added $12.04 million, bringing the cumulative three-week total to $382 million. XRP ETFs launched with $243 million in second-day inflows. Canary's XRPC traded $55.5 million in first-day volume, matching Solana's record debut.

Think about what that means. During the worst crypto selloff in months, with Bitcoin touching six-month lows and the Fear & Greed Index in extreme fear territory, institutions poured hundreds of millions into new altcoin products. They're not fleeing crypto. They're rotating capital. They're repositioning for the next phase.

And while retail traders watch their portfolios bleed and wonder if they should capitulate, Harvard University just tripled its Bitcoin ETF position to $442.8 million, a 257% increase from June. JPMorgan disclosed holdings of BlackRock's IBIT worth over $340 million. These moves happened during the selloff, not before it.

The divergence between institutional behavior and retail sentiment has never been wider. Institutions are accumulating. Retail is panicking. The wealth transfer is happening in real time, and most people are on the wrong side of it.

Why This Matters More Than You Think

The death of the four-year cycle isn't just about timing. It's about limits. The entire thesis that Bitcoin "can't go higher than $120K this cycle" was built on historical diminishing returns within the four-year framework. If the framework is broken, the ceiling is broken too.

We're not just in uncharted territory. We're in no territory. There is no historical map for a post-ETF, institutionally-dominated Bitcoin market that doesn't follow the halving cycle. Every model based on previous cycles is now obsolete. Every YouTuber screaming for an 80% bear market is relying on outdated data. Every prediction anchored to the old pattern is potentially worthless.

This is the inflection point. November 2025 is the fork in the road. Either Bitcoin fails to bounce from the 50-week EMA and we get the slow, grinding bear market everyone expects, proving the cycle just got delayed. Or Bitcoin bounces hard, breaks to new highs in Q1 2026, and the old playbook gets thrown out entirely.

I've been in crypto since 2014 because I learned to recognize when the rules change. The rules have changed. ETFs didn't just provide institutional access to Bitcoin. They fundamentally altered the market structure. They created a mechanism for coordinated accumulation and distribution at scale. They introduced quarterly performance pressures that don't care about four-year cycles. They turned crypto into just another asset class that moves on institutional timeframes, not retail emotion.

The question isn't whether Bitcoin will recover. The fundamentals haven't changed: the network keeps growing, adoption keeps expanding, regulatory clarity keeps improving, and major institutions keep building infrastructure. The question is whether you recognize that the game has changed and adjust your strategy accordingly, or whether you keep playing by the old rules while institutions extract wealth using the new ones.

We're watching it happen right now. Long-term holders distributing 815,000 BTC. ETFs bleeding billions. Retail capitulating. Then Harvard tripling down, whales accumulating 36,000 BTC in a week, and altcoin ETFs printing record inflows during the chaos. This isn't market inefficiency. This is the new market operating exactly as designed.

The four-year cycle is dead. The six-month institutional rotation cycle has replaced it. And if you're not paying attention to ETF flows, on-chain distribution patterns, and the divergence between institutional and retail behavior, you're playing a game where you don't even know the rules anymore.

We'll be watching the 50-week EMA. We'll be watching ETF flows. And we'll be watching whether Bitcoin can reclaim $105K to confirm the bounce. Because this month determines whether we're witnessing a delayed bear market or the birth of a completely new market structure.

Either way, somebody's going to make a fortune. The question is whether it's you or the institutions that just convinced you to sell at the bottom.

This isn't a dashboard. This is a tactical briefing, peeling back the layers on the market's core assets.

Battlefield Intelligence: What the Numbers Truly Reveal.

Evolution Check: Last week we told you to watch $100K on Bitcoin, $3,300 on Ethereum, and $150 on Solana. All three broke. We've seen this movie before: in 2014, 2018, 2022, and every other cycle where retail panics and OG holders take profits. The difference between survivors and casualties? Understanding that volatility is a feature, not a bug.

Here's the reality: Bitcoin ETFs hemorrhaged $870 million on Thursday, the second-largest single-day outflow in history. Long-term holders dumped 815,000 BTC over the past 30 days, the highest distribution since January 2024. Bitcoin briefly touched $94,147, its lowest level since May. Over $1.1 billion in leveraged positions got liquidated in 24 hours. The Fear & Greed Index crashed to 22, marking extreme fear not seen since March.

Is this bad? Yes. Is this the end? Not even close.

We watched Bitcoin fall 94% from $1,200 to $200 in 2014-2015. We traded through 2018's nuclear winter when it dropped 84% from $20K to $3K. We bought the March 2020 COVID crash when Bitcoin fell 50% in 48 hours. Every single time, the pattern repeats: OG holders extract profits, retail capitulates, institutions accumulate quietly, fundamentals keep improving, and the next leg up catches everyone off guard.

The standout signal this week? While Bitcoin and Ethereum ETFs bled nearly $670 million on Thursday alone, Solana ETFs added $12 million and XRP ETFs launched with $243 million in inflows on their second day. When institutions pour hundreds of millions into new altcoin products during a bloodbath, they're not fleeing crypto; they're repositioning for what comes next.

Bitcoin: $96,219 - Testing the Line Between Correction and Capitulation

Week-over-week: -5.39%

Bitcoin fell below $95,000 on Thursday for the first time in six months, touching $94,147 before recovering above $96K. The selloff was surgical and brutal: $870 million in ETF outflows (second-largest ever), 815,000 BTC sold by long-term holders in 30 days, and $1.1 billion in leveraged longs liquidated.

The ETF hemorrhaging tells the story. Since October 10th, Bitcoin ETFs have recorded net outflows of $3.43 billion, with redemptions occurring on 16 of the last 25 trading days. Thursday's $870M exit was exceeded only once in history. Grayscale's Bitcoin Mini Trust alone bled $318.2 million in a single session. This isn't retail panic; this is institutional repositioning.

Long-term holders are taking profits at the highest rate since January 2024. According to CryptoQuant, these OG wallets realized $3 billion in profits on November 7th alone. Their share of total Bitcoin supply dropped from 76% to 70% in one month. That's $79 billion worth of Bitcoin changing hands, the largest distribution wave since the 2021 peak.

Here's what retail misses: net realized losses remain virtually zero. Nobody's capitulating. This is methodical profit-taking from holders who bought at $15K-$40K and are now booking six-figure gains at $95K. When experienced investors sell without panic and losses stay near zero, that's not the behavior of a dying market; that's wealth redistribution from patient holders to new money.

The technical picture is cleaner than sentiment suggests. Bitcoin is testing its 365-day moving average around $102,000, which has served as ultimate support throughout this entire bull cycle. CryptoQuant's Ki Young Ju notes that investors who bought 6-12 months ago have a cost basis near $94,000. Unless BTC loses that level decisively, we're not entering crypto winter; we're consolidating after a 300% run from 2023 lows.

Liquidation data shows $582.75 million in long positions clustered near $98,000. If volatility accelerates, we could see a quick sweep of the lows before the bounce. This is classic stop-hunting behavior that precedes reversals. Smart money knows exactly where retail's stops are sitting.

What we're watching: Bitcoin needs to reclaim $100K decisively to flip sentiment. Above $105K, the structure improves significantly. Below $94K on high volume, we're looking at potential tests of $88K-$92K. But here's the thing: every retest of major support in this cycle has been followed by stronger rallies. November historically delivers 11.2% median returns. We're two weeks in and down 5%. The setup is there.

Key levels:

Support: $96K (holding), $94K (major), $88K (catastrophic if broken)

Resistance: $100K (psychological), $105K (momentum shift), $110K

Context: $870M ETF outflows = second-largest ever, but altcoin ETFs still attracting capital

The Fear & Greed Index at 22 signals extreme fear. You know what that means? The bottom is probably closer than anyone thinks. We've been in this game since 2014 because we learned to buy when everyone's terrified.

Ethereum: $3,178 - The Forgotten Giant

Week-over-week: -6.08%

Ethereum continues its underperformance story, falling below $3,200 as ETF outflows hit $177.90 million on Thursday alone. That marks the fourth consecutive day of redemptions. Since October 29th, Ethereum ETFs have bled $1.4 billion in cumulative outflows. ETH is now trading 36% below its August peak of $4,951.

The pain is real, but the context matters. ETH fell 18% in the week following Solana's ETF launch while SOL products pulled in $417 million. The narrative shifted: Solana got the "next generation blockchain" branding while Ethereum got stuck with "expensive and slow." Wrong, but narratives drive price action in the short term.

Here's what the market's missing: Ethereum's fundamentals keep improving while price action deteriorates. Gas fees are near historic lows at 0.25-0.50 gwei (literally $0.02 for a transfer). Layer-2 solutions are scaling transaction capacity. The infrastructure is there. The adoption is growing. But markets don't pay for future promises during corrections; they pay when upgrades deliver results.

On-chain data shows $643 million in ETH exiting exchanges recently, reducing immediate sell pressure. Negative funding rates persist, offering short squeeze fuel if buyers show up. The technical setup for a violent reversal is building; it just needs a catalyst.

The ETH/BTC ratio sitting around 0.033 tells you everything about relative weakness. But here's the pattern we've seen before: when Ethereum gets left behind during corrections, it tends to catch up explosively during the next rally. The 2021 bull run had five separate 30%+ ETH corrections before hitting all-time highs.

What we're watching: ETH needs to hold $3,100-$3,200 to keep the structure intact. Above $3,500, sentiment starts shifting. Above $3,800, we're back in consolidation range for the next leg. The Fusaka upgrade remains the catalyst that changes everything: enhanced data availability from 6 to 48 blobs per block means real scaling.

Key levels:

Support: $3,178 (current), $3,100 (critical), $3,000 (panic)

Resistance: $3,500 (reclaim target), $3,800 (momentum), $4,100

Catalyst: Fusaka upgrade + short squeeze setup from negative funding

We've held ETH through worse. Much worse. The 2018 crash saw Ethereum fall from $1,400 to $80 (94% drawdown). This 36% pullback? This is just volatility in a bull market. Patience wins.

Solana: $141.58 - The Contrarian Signal

Week-over-week: -10.07%

Solana fell 10% this week to $141.58, but here's the story nobody's telling: while Bitcoin and Ethereum ETFs bled billions, Solana ETFs printed their 14th consecutive day of inflows. Thursday added $12.04 million. Cumulative total: $382.05 million in less than three weeks. That's not a trade. That's a statement.

Let that sink in. During the worst crypto selloff in months (with Bitcoin touching six-month lows and $1 trillion erased from market cap), institutions added another $12 million to Solana positions. This is accumulation disguised as weakness. This is smart money building while retail watches numbers go down and feels poor.

The XRP ETF launch this week provides more evidence. XRP ETFs launched Wednesday with zero flows, then printed $243 million in inflows Thursday. Canary's XRPC traded $55.5 million in volume on day one, matching Solana's record October debut. The message is clear: institutions want exposure to next-generation blockchains, not just Bitcoin and Ethereum.

Solana's infrastructure keeps strengthening while price consolidates. BlackRock's BUIDL fund on Solana crossed $250 million with accelerated growth since September. Major stablecoin projects are choosing Solana for settlement. The network handles volume without breaking a sweat while other chains struggle with congestion.

The technical setup is straightforward. SOL broke below $150, triggering stop losses and liquidations. But the ETF flows tell a different story than price action. When institutional money flows opposite to price movement, one of them is wrong. We're betting on the money.

What we're watching: Solana needs to reclaim $150 to stabilize the structure. Above $165, we're back in consolidation mode. Above $180, momentum shifts decisively bullish. The $300 breakout is a when, not if; ETF flows guarantee it.

Key levels:

Support: $141 (current), $130 (major), $120 (extreme)

Resistance: $150 (critical reclaim), $165 (consolidation), $180 (momentum)

Signal: 14 straight days of ETF inflows during market crash = institutional conviction

We've seen this pattern before. Smart money accumulates while retail panics. Then price catches up to flows and everyone acts surprised. We won't be surprised.

The KillChain Disclaimer

Intelligence, Not Advice

The KillChain delivers battlefield intelligence on crypto markets, not personalized investment advice. Everything in this newsletter (market commentary, technical analysis, price levels, "accumulation zones," and any other tactical language) is provided strictly for educational and informational purposes. Nothing here constitutes investment, legal, accounting, or tax advice.

No Recommendations, Just Information

When we reference "buy zones," "accumulation," "trimming," or similar language, we're describing market frameworks and our own analytical perspective, not telling you what to do with your money. These are illustrative concepts, not specific recommendations to buy, sell, or hold any digital asset, security, or derivative.

You're In Command

You alone are responsible for evaluating the merits and risks of any information presented before making investment or trading decisions. Consult a registered investment adviser, financial planner, or other qualified professional regarding your individual circumstances. Seriously. Do your own research. Verify everything. Trust no one, including us.

Crypto Is Volatile and Risky

Digital assets are highly volatile and speculative. You can lose some or all of your investment. Past performance (ours or anyone else's) doesn't predict future results. Markets can and do go to zero. Regulatory landscapes shift. Exchanges fail. Wallets get hacked. If you can't afford to lose it, don't invest it.

We're Not Your Financial Advisors

The FraudFather and KillChain contributors may hold positions in assets discussed. We're sharing our analysis and perspective as experienced market participants, not acting as your fiduciary, broker, or adviser. Our interests may not align with yours.

Stay Sharp. Stay Solvent.

This newsletter is for sophisticated readers who understand risk management and personal responsibility. If you're looking for someone to hold your hand and guarantee returns, you're in the wrong place. We provide intelligence. You make decisions.