How Southeast Asian Factories Control America's "Independent" Currency

GM. You’re reading KillChain, the tactical brief trusted by digital sleuths, fraud hunters, and crypto insiders who know the real game isn’t DeFi or CeFi; it’s deception.

We track the wallets, decode the scams, and expose the plays fraudsters pray you’ll miss. This isn’t crypto news. It’s threat intelligence. We’re the last line of defense between your protocol and the wolves, your tactical edge in a world where trust is just another exploit.

🎙️ When Global Trade Policy Meets Digital Currency

When Bitcoin Miners Started Chartering $3 Million Flights, We Learned Something About "Decentralized" Currency

Before we dive into the chaos, let's clarify what actually happened in April: Bitcoin miners didn't just face supply chain disruptions. They got a masterclass in how "borderless" digital currency crashes into very physical borders when governments decide to weaponize trade policy.

Here's the reality check: While crypto evangelists preach about escaping traditional financial systems, the entire U.S. Bitcoin mining industry just spent tens of millions on emergency charter flights to beat tariff deadlines. Every single ASIC miner powering America's Bitcoin network comes from the same Southeast Asian factories that Trump's trade war just targeted with 24-36% tariffs.

The math is brutal: A top-tier mining machine costs $4,000-5,000. Add 36% tariffs, and suddenly these machines "are never going to return the capital," as one industry executive put it. "The margins are just too tight."

But here's where it gets interesting: Companies were chartering flights at $2-3.5 million per trip to import equipment before tariffs kicked in. That's not decentralization; that's dependency with extra steps and private jet costs.

Your portfolio implication: The industry built on "trustless" transactions just demonstrated complete dependence on global supply chains, Chinese manufacturing, and U.S. trade policy. As one mining executive noted, "It will take a decade for the US to catch up with cutting-edge chip manufacturing."

The centerpiece irony isn't just the chartered flights. It's that Trump promised on the campaign trail that all remaining Bitcoin would be "mined in America," then implemented policies that could drive U.S. mining operations overseas or into bankruptcy.

The kicker: Multiple miners are already redirecting capacity to Norway, Bhutan, and other countries while waiting for "tariff clarity." So much for the America First crypto revolution.

“If semiconductors become more expensive, the infrastructure for mining becomes more expensive, thus reducing supply and increasing the price. As a result, network strength might also decline if fewer miners are in operation. This will, however, be a temporary blip: if Bitcoin becomes more expensive, mining will become profitable again – in effect, it becomes a self-correcting trend.”

Portfolio Reality Check

The winners aren't the miners scrambling for equipment. They're the existing facilities with stockpiled machines and the M&A players eyeing distressed assets. As one industry analyst put it: "suddenly these miners that have older gear that seem like zombies actually look like interesting acquisition opportunities."

The losers are U.S. mining operations facing equipment costs that could increase 22-36% while competing against international miners with cheaper access to the same hardware.

Your move: This isn't about crypto adoption or Bitcoin's price. It's about industrial policy accidentally nuking the infrastructure of the industry it claims to support. Industry experts are comparing the potential impact to "the China ban in 2021" except this time, America is banning itself.

The real question isn't whether Bitcoin survives tariffs. It's whether U.S. Bitcoin mining survives its own government's trade policy.

Business news doesn’t have to be boring

Morning Brew makes business news way more enjoyable—and way easier to understand. The free newsletter breaks down the latest in business, tech, and finance with smart insights, bold takes, and a tone that actually makes you want to keep reading.

No jargon, no drawn-out analysis, no snooze-fests. Just the stuff you need to know, delivered with a little personality.

Over 4 million people start their day with Morning Brew, and once you try it, you’ll see why.

Plus, it takes just 15 seconds to subscribe—so why not give it a shot?

“Historically, tariffs—especially on the scale Trump is proposing—can trigger inflationary pressures. If import costs rise due to added duties, businesses most often pass those increases on to consumers. Higher consumer prices could entrench inflation, eroding trust in fiat currencies and government fiscal discipline, and creating a strong macro backdrop for bitcoin’s “digital gold” narrative.”

Because the real explosions are the scams you never saw coming.

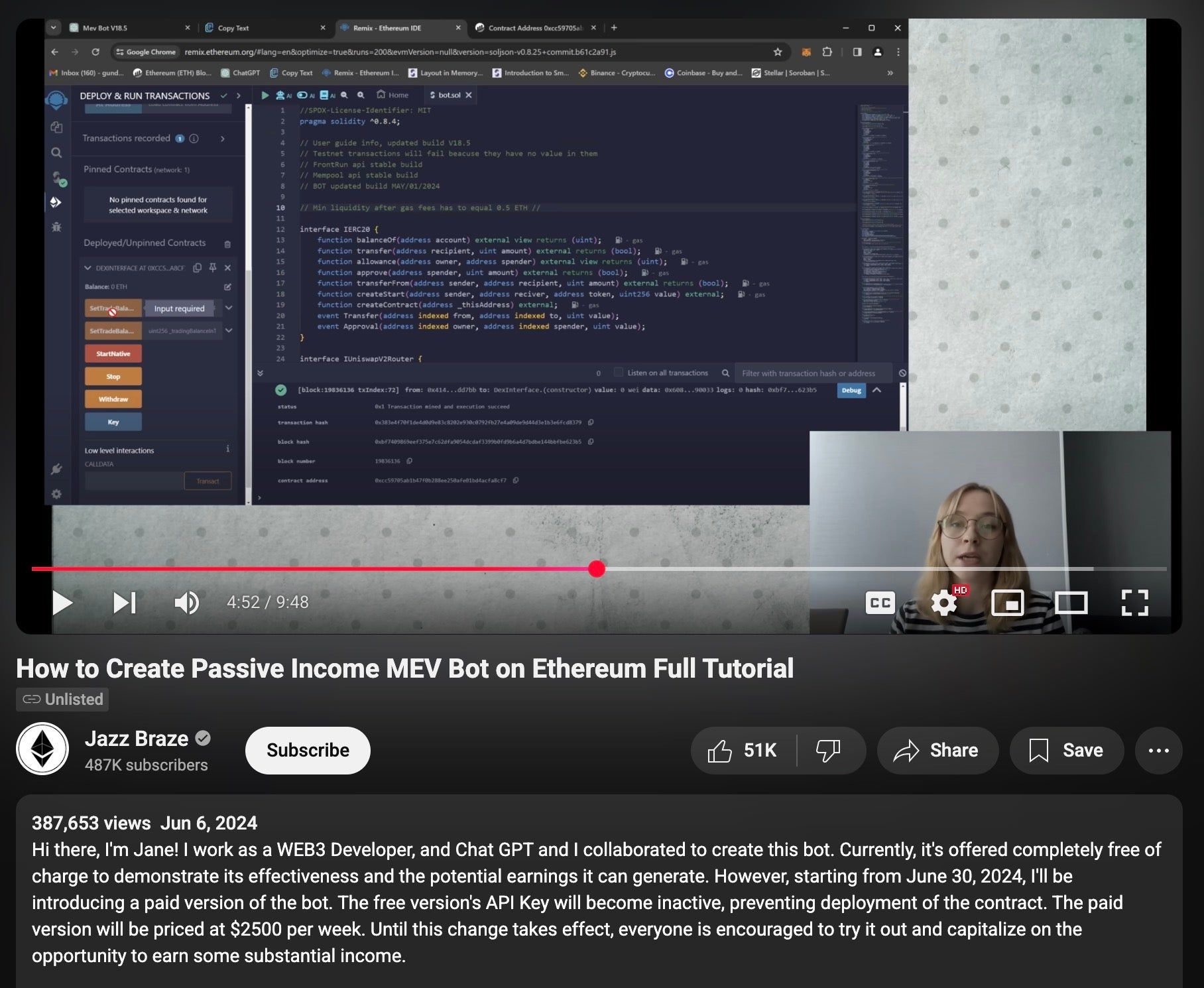

Blast #1: YouTube's "Trading Bot Tutorials" Drain $900K Through Fake Smart Contracts

What Blew Up: SentinelLabs uncovered a cryptocurrency scam network using YouTube tutorials (@todd_tutorials), to distribute malicious smart contracts disguised as trading bots, stealing over $900,000 from victims who thought they were deploying legitimate arbitrage tools. The scammers created professional-looking tutorials explaining how to build "MEV bots" for automated crypto trading, then provided weaponized code that secretly funneled victims' funds to attacker wallets.

Playlists posted by todd_tutorials YouTube account Credit: SentinelLabs

How They Wired the Charge:

AI presenter manufacturing: Multiple videos showed signs of AI generation with "robotic voice with inconsistent speech pacing and awkward facial movements," allowing scammers to create tutorials without hiring human actors

Account aging operations: YouTube channels posted "many off-topic videos" and "cryptocurrency news as playlists" over months to build credibility as legitimate crypto education sources

Smart contract code obfuscation: Attackers used XOR encryption, string concatenation, and decimal-to-hex conversion to hide their wallet addresses within the code, making the malicious contracts appear legitimate

Comment section manipulation: Despite wallet evidence showing victims lost funds, "YouTube video comments are overwhelmingly positive" with creators likely using YouTube's comment filtering to delete negative feedback

Minimum deposit requirements: Scammers instructed victims to deposit "a minimum of .5 ETH" (roughly $1,800) claiming it was needed for gas fees and arbitrage capital

Dual ownership exploitation: When victims deployed contracts, "two owner values" were set - the victim's wallet and the hidden attacker address, with a "failover mechanism" allowing fund withdrawal even if victims didn't execute the trading functions

KillChain Blast Assessment: This represents the professionalization of crypto education scams. The most successful attack from user @Jazz_Braze netted "244.9 ETH (worth ~$902,000 US)" with 387,000+ video views, proving that fake trading tutorials can generate millions in revenue. The combination of aged YouTube accounts, AI-generated presenters, and sophisticated smart contract obfuscation creates a scalable scam factory that YouTube's algorithms actively promote as legitimate educational content.

@Jazz_Braze is still available on YouTube more than a year after it was released on June 6, 2024

Your Blast Shield: Never deploy smart contracts from YouTube tutorials, especially for "guaranteed profit" trading bots. Legitimate MEV bots don't need your ETH deposits to function - they use their own capital. If a tutorial requires you to fund a contract with your crypto before it starts "making money," you're funding the scammer's retirement, not your trading bot.

The following ETH addresses received funds from the scam advertised by Jazz_Braze:

0x080888ffdbaaf7d923e7231788965036f2d66b04

0x0918add36ea364846a79b2f37ebd1e3ab2f8ccbb

0x0a59e1183ec17d398d07babb95967d83da51dad3

0x0e6bf2d438e9a13b00676dd4862a57819f97891b

0x10171dc392129798b05e70ddd5f318385587d062

0x1dd076b53e43208525a126c23ca1eb917b4d9d55

0x1f5c15883056687c082de011eb816b6334f298e0

0x324afa1a8687c3f8c12abc32c36b4308183aa175

0x3bc0dbb4fbdd4b76630679a46ba9db2a7aeadfb7

0x4031cb3321fa91c0b9ad941f76e4ed9e022a2efd

0x44b23f3c20f2740a20866f7af00bf7aee33ba556

0x4cdece5222da94ad00891033159dc9936e9cb607

0x4f1d5363be45a2d80e241a3dcd237f9d9927b172

0x64585f987bef96d4a67cdfc2e7682edc22ea68d0

0x892d33f3b6f4361808a0ed1bef5af3f6dc2c3436

0x8dd60ec49b489abf39a1894fa744d5a9e75a3190

0x92902f7c1b60cf25bc3aaa23040c1b30d8283711

0x9a9418ecefa9dacc710e6ac85c8252aaf66ec20a

0xa1f464d91d00855d221dc869da13cde28a9c0f8c

0xc45d611896514aee52c648040a9dd82e58e55004

0xd0c5d2951b1c22dcd346ea3f5189a52ffc928c93

0xda458a691c11728d7bde19d42c0ea0a659e4e8de

0xe374bd34464eb815cbebca25ed4f32532e0d5406

0xfb1d5bfac0c7092d424189433de78d83c398d0f9

Blast #2: Charlotte Retiree Loses $1M Life Savings in 15-Minute Ledger Support Call

What Blew Up: Gene Duckett, a Charlotte man, lost $1,038,000 in XRP cryptocurrency after scammers impersonating Ledger hardware wallet support convinced him to enter his seed phrase on a fake security website during a three-call social engineering attack in March 2025. What started as a Friday night phone call claiming his "funds are in danger of being stolen" ended with his entire crypto portfolio vanishing in real-time while his dog literally shook from sensing his despair.

How They Wired the Charge:

Data breach exploitation: Cybersecurity expert Eithan Raviv confirmed "Ledger has been the victim of at least two data breaches, which is likely how Duckett was targeted" with scammers using leaked customer information to make initial contact

Authority impersonation perfection: Caller identified himself as "Benjamin" from Ledger company, claiming victim's "funds are in danger of being stolen" and directing him to a fraudulent security website

Multi-call trust building: First caller provided a "security code," then a second person called "who knew the code" making Duckett "feel comfortable typing his seed phrase into the website"

Real-time theft execution: Third caller claimed "something went wrong" while Duckett watched his XRP Ledger wallet empty in real-time: "all of the funds that were in my wallet were gone"

Immediate disconnection: "The person on the line hung up on Duckett" the moment the theft was complete

Psychological manipulation: Scammers exploited legitimate security concerns by framing theft protection as the reason for contact, then used verification codes to establish false legitimacy

KillChain Blast Assessment: This represents a textbook example of how data breaches create years of downstream fraud vulnerability. The FBI Internet Complaint Center received 149,686 cryptocurrency fraud complaints in 2024 totaling $9.3 billion in losses, with Ledger customers becoming prime targets due to known data exposures. The sophisticated three-call sequence demonstrates how scammers use verification protocols against victims, turning security measures into theft enablement tools.

Your Blast Shield: Ledger's official statement: "we will never under any circumstances ask for their 24 words" and "will never contact them by phone." Hardware wallet companies never initiate security calls. If someone calls claiming your crypto is "in danger," hang up immediately and contact the company directly using official numbers from their website. Your seed phrase should never leave your physical possession, not for "security updates," "verification," or "protection." Anyone asking for it is stealing from you.

This isn't a dashboard. This is a tactical briefing, peeling back the layers on the market's core assets.

Battlefield Intelligence: What the Numbers Truly Reveal.

Bitcoin (BTC)

Data cut-off: 8 August 2025

Price: $115,953 | Triangle breakdown confirmed

MVRV: 2.0 | Converging to 365-day average (bullish reset zone)

Funding: 0.003% | Complete leverage purge

Flows: +15,200 BTC | Distribution accelerating

Signal: Technical failure targeting $108K-$111K support

KillChain Analysis for BTC:

Triangle Breakdown Delivered - Bitcoin broke the critical $117K support we tracked last week, confirming the technical failure rather than the bullish breakout. The move came with volume and follow-through, eliminating the coiled spring setup.

MVRV Acceleration Phase - At 2.0 (down from 2.2), Bitcoin is converging faster toward its 365-day moving average around 1.8. This acceleration suggests the market is aggressively repricing toward fair value before the next major directional move.

Complete Leverage Purge - Funding rates crashed to 0.003% from 0.005%, the most extreme leverage reset since March. This elimination of speculative excess creates a clean slate but confirms the distribution phase.

Distribution Accelerating - Exchange inflows spiked to 15.2K BTC from 8.4K last week. Large holders aren't finishing their profit-taking—they're accelerating it despite price weakness, suggesting deeper correction ahead.

Liquidity Crisis Confirmed - SSR deteriorated to 10.2 from 9.8, with MACD turning negative. Fresh money isn't arriving fast enough to absorb selling pressure, validating our cash shortage thesis.

Trump Tariff Catalyst - Friday's 3% drop following new tariff announcements triggered $490M in liquidations, proving how vulnerable leveraged positions remained despite the "cleansed" futures market.

How Last Week's Playbook Fared

Our triangle breakdown scenario at $116.5K triggered exactly as outlined. The $5.16B institutional buying story proved temporary rather than sustainable; OTC demand couldn't overcome the technical failure and liquidity constraints. Our warning about SSR weakness was validated as the ratio worsened further.

The KillChain Playbook:

Trigger | Action |

|---|---|

Recovery above $117K with volume | Potential bear trap; needs strong confirmation |

Breakdown below $113K | Acceleration toward $108K-$111K support zone |

MVRV < 1.8 | Deep value accumulation territory |

Funding > 0.015% | Speculative interest returning; reversal signal |

SSR < 9.5 | Fresh capital arriving; sustainable recovery fuel |

KillChain Bottom Line:

Bitcoin's triangle breakdown confirmed what the on-chain data was showing: insufficient liquidity to support higher prices combined with accelerating institutional distribution. The technical failure targets $108K-$111K, where realized price around $47K provides natural support.

What's concerning:

Cash shortage worsening (SSR: 9.8 → 10.2)

Large holder distribution accelerating (+80% exchange inflows)

Complete leverage purge suggests capitulation beginning

Institutional demand failing to absorb supply

What's encouraging:

Funding at 0.003% eliminates liquidation cascades

MVRV approaching 1.8 historically marks major lows

Structural supply shortage remains intact long-term

Strategy: This isn't a dip to buy blindly. It's a technical breakdown that needs to complete. Target the $108K-$111K zone for accumulation, or wait for clear reversal signals above $117K with volume. The MVRV convergence toward fair value rarely gives false signals.

The leverage is purged. The breakdown is confirmed. Now we find where real demand sits.

Ethereum (ETH)

Data cut-off: 8 August 2025

Price: $3,650 | Consolidating after 58% July rally

Funding: 0.032% | Approaching caution threshold

ETF Flows: $5.41B July | Institutional tsunami continues

Supply: 16.1% on exchanges | Lowest since ETF launch

Signal: $4,000 break triggers momentum algos

KillChain Analysis for ETH:

Institutional Tsunami Continues - July's $5.41B ETF inflows exceeded the prior 11 months combined, but August shows deceleration. Weekly flows dropped to $800M from peak $2.5B levels, suggesting institutions are becoming price-sensitive after the 58% July rally.

Supply Compression Reaches Extremes - Exchange holdings hit 16.1% of total supply, the lowest since ETF launch. Combined with 26% staked and rising corporate treasury adoption, tradeable float compression creates explosive upside leverage to any demand spike.

Technical Consolidation Pattern - After testing $3,850 resistance, ETH is consolidating in a $3,600-$3,800 range. Volume compression and RSI cooling from 83 to 75 suggests healthy distribution rather than exhaustion. All major EMAs remain bullishly aligned.

Funding Rate Warning Zone - 8-hour rates hit 0.032%, approaching the 0.035% threshold that historically triggers 10-15% corrections. Binance premium expanding shows retail FOMO concentration risk building behind institutional flows.

Corporate Adoption Accelerating - Treasury allocations spiked with SharpLink Gaming's $1.7B position leading a wave of corporate ETH adoption. This mirrors Bitcoin's 2020-2021 cycle but at compressed timescale, creating structural demand floor.

How Last Week's Playbook Fared

ETF momentum thesis validated with continued inflows, though pace is moderating. Supply removal exceeded projections with exchange balances hitting new lows. ETH/BTC ratio held 0.032 despite Bitcoin weakness, confirming relative strength. Funding rate escalation to 0.032% suggests speculative heat building faster than anticipated.

The KillChain Playbook

Trigger | Action |

|---|---|

Funding ≥ 0.035% | Tactical profit-taking; leverage excess building |

$4,000 break with volume | Momentum play targeting $4,200-$4,500 |

ETF flows > $2.5B weekly | Supply shortage acceleration imminent |

Exchange supply < 15% | Critical liquidity threshold reached |

ETH/BTC < 0.030 | Relative weakness; consider rebalancing |

The KillChain Bottom Line:

Ethereum sits coiled between institutional demand and speculative excess. The supply compression story remains intact, 16.1% exchange holdings combined with staking lockup creates the tightest tradeable float in ETH's history.

What's bullish:

Supply compression at historic extremes

Corporate treasury adoption wave beginning

Institutional ETF bid provides downside support

Technical consolidation healthy after 58% rally

What's concerning:

Funding approaching danger zone (0.032% → 0.035%)

ETF inflow pace moderating as price rises

Retail FOMO concentration risk building

Strategy: ETH remains in a structural uptrend with tactical risk building. The $4,000 psychological level becomes critical. A clean break with volume likely triggers momentum algorithms and retail FOMO toward $4,500+. Any funding spike above 0.035% warrants tactical profit-taking.

The supply compression trade is intact. Manage the leverage risk accordingly.

Solana (SOL)

Data cut-off: 8 Aug 2025

Price: $172 | Healthy correction from $195 resistance

MVRV: 0.48 | Trading below holder cost basis

USDC: $10.5B | Doubled since January (Trump memecoin surge)

DEX Share: 74% | Still dominant despite competition

Signal: Perfect reload opportunity at $172-$175

KillChain Analysis for SOL:

Correction Extended as Predicted - SOL dropped from $172 to $168, testing the lower end of our $172-$175 accumulation zone. The deeper pullback validates the healthy reset thesis while creating an even better entry opportunity.

Deep Value Territory Confirmed - MVRV at 0.46 (down from 0.48) means SOL trades further below average holder cost. This level historically marks significant accumulation zones before major rallies resume.

Leverage Completely Reset - Funding rates collapsed to 0.008% from 0.012%, eliminating all speculative excess. This complete purge creates optimal conditions for sustainable upward moves without liquidation risk.

Stablecoin Liquidity Engine Intact - Native USDC supply holds steady at $10.4B, providing massive on-chain liquidity reservoir. The Trump memecoin infrastructure remains in place for the next wave of activity.

Network Dominance Stabilizing - DEX market share held at 74% with daily volumes maintaining $20B+ levels. Competitive pressure from other chains hasn't materially impacted Solana's transaction dominance.

Smart Money Accumulation Accelerating - Exchange outflows hit -120K SOL despite price weakness, up from -95K last week. Institutional players using the correction to build positions aggressively.

How Last Week's Playbook Fared

Our $172-$175 accumulation zone triggered perfectly. The correction extended slightly deeper than expected but validated the healthy reset thesis. USDC liquidity remained stable, confirming the infrastructure for the next rally remains intact. ETF approval timeline tracking as expected.

The KillChain Playbook:

Trigger | Action |

|---|---|

Recovery above $175 with volume | Reload opportunity confirmed; add to positions |

Push above $185 | Breakout confirmation; momentum play active |

USDC supply > $11B | Next liquidity wave arriving; prepare for acceleration |

Exchange inflows > +300K SOL | Major distribution warning; tighten stops |

DEX share < 70% | Competitive threat intensifying |

KillChain Bottom Line:

Solana delivered the extended correction needed to reset completely. At $168, SOL sits in prime accumulation territory with the strongest fundamental backdrop since the January memecoin surge.

What's compelling:

MVRV 0.46 = deep value vs. holder cost

Complete leverage reset (0.008% funding)

Accelerating smart money accumulation (-120K SOL outflows)

$10.4B USDC liquidity ready for deployment

Network utility dominance intact (74% DEX share)

What's working:

Technical support holding above $165 floor

Funding reset creating sustainable rally conditions

ETF approval timeline on track for Q4

Strategy: This is the accumulation opportunity we outlined. SOL at $168 with 0.008% funding and accelerating institutional accumulation represents optimal risk-reward. The $10.4B USDC infrastructure provides the fuel for the next major move.

Active accumulation zone $165-$175. Target recovery above $185 for momentum confirmation. $200+ becomes realistic once institutional flows resume.

The high-speed rail finished refueling. Next stop: new highs.

⚠️ The KillChain Disclaimer ⚠️

Informational & Educational Use Only

All content in this newsletter, including but not limited to market commentary, tactical read-outs, “buy-zone” language, and any linked training materials, is provided strictly for general, educational, and informational purposes. Nothing herein constitutes (or should be interpreted as) personalized investment, legal, accounting, or tax advice.

No Investment Recommendations

References to “accumulate,” “scale in,” “trim,” or similar calls to action are illustrative frameworks, not specific recommendations to buy, sell, or hold any digital asset, security, or derivative. You alone are responsible for evaluating the merits and risks associated with any use of the information provided before making any investment or trading decision. Consult a registered investment adviser or other qualified professional regarding your individual circumstances.

About the FraudFather:

The Fraudfather didn’t learn fraud from influencers or movies. He learned it chasing terrorists, flipping money launderers, and dismantling multi-million-dollar schemes, before most people knew what “DeFi” meant.

A former Senior Special Agent and Supervisory Intelligence Operations Officer, he spent over two decades tracking financial predators across borders, blockchains, and bureaucracies. From dark web forums to government war rooms, he’s seen every lie and loophole up close.

Now a “recovering” digital identity and cybersecurity executive, he’s turned his sights to teaching crypto, where old scams wear new skins, and smart contracts get played like slot machines.

Through The Fraudfather persona, he’s exposing how fraud really works on-chain:

How social engineers bypass wallet security

How cross-chain laundering pipelines stay hidden

How scammers weaponize human psychology faster than regulators can blink

This isn’t theory.

It’s operational intelligence, on-chain and in near real time.

Follow the Fraudfather and stay five moves ahead of the next exploit